US stimulus package lifts hopes

Brent prompt contract regained Monday’s losses to reach 56 $/b, despite a strengthening dollar. At the same time, diesel margins progressed higher in Europe and Asia.…

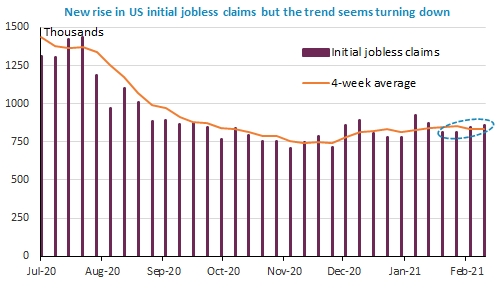

When US jobless claims figures showed an unexpected second increase in a row yesterday, we thought the stock and bond market would both love them, but that was not the case: US equities were down for the 3rd day in a row in 2021 and the US 10y bond yield stands above 1.3% this morning. Bond yields in Europe have started rising more significantly too, so that the spread with US Treasuries is narrowing, which supports the euro vs the USD: the EUR/USD was back to 1.21 this morning.

Get more analysis and data with our Premium subscription

Ask for a free trial here