Power and emissions markets extended losses amid muted activity

The European power spot prices remained impressively stable yesterday as forecasts of slightly higher French nuclear availability and German wind output offset the stronger demand…

European equities had their worst day of the year and US equities plunged the most in two months. Bond yields were sharply down, the US 10y falling below 1.2%, its lowest level since February. Implicit inflation expectations fell as well and the yield curve flattened further… etc. To sum up, the exit from the reflation trade sharply accelerated yesterday, almost as fast as the spread of the Delta variant.

US equity futures have rebounded and bond yield stabilized. The USD as well seems less volatile, the EUR/USD clinging to the level of 1.18 or a bit below. Nothing really new to support this change of trend but the correction was just very sharp and the markets will probably take a breather.

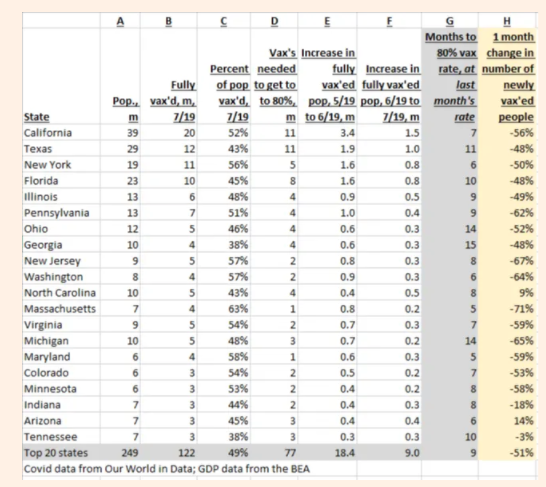

On the agenda today, US construction data: building permits have been on a downward trend since the start of the year, but remain very high. The NAHB survey released yesterday was consistent with this moderation in activity but still at high level. Instead, the markets should be looking at everything to do with the pandemic, including the central issue of vaccination, the pace of which is slowing alarmingly in the US, as shown in this table from Robert Armstrong’s column in the FT.