Indian demand bounces back

Yesterday’s EIA data release had a surprisingly bullish tone, with stock draws across the board, particularly in seasonally building products such as gasoline and propane.…

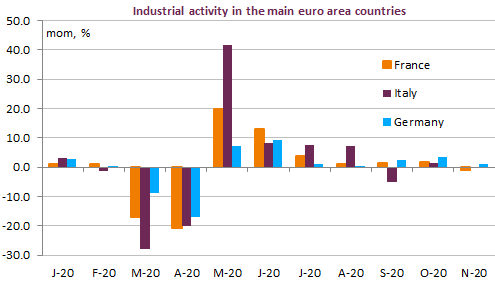

Markets are pausing, weighing prospects of stronger fiscal stimulus in the US against the acceleration of the spread of the pandemic, especially in Europe, where lockdown measures are being reinforced and extended. Some Fed officials also calmed down talks about a reduction in bond purchases as soon as this year, therefore helping to stop both the bond yields and the USD ascent. The EUR/USD is trading above 1.22. Donald Trump denied having done anything wrong last week, but should be impeached a second time.

Get more analysis and data with our Premium subscription

Ask for a free trial here