Crude draws continue to support the oil complex

ICE Brent crude prices continued to rise, reaching, 76.4 $/b on early Thursday, amid drawing inventories in the US and despite a rise of the US…

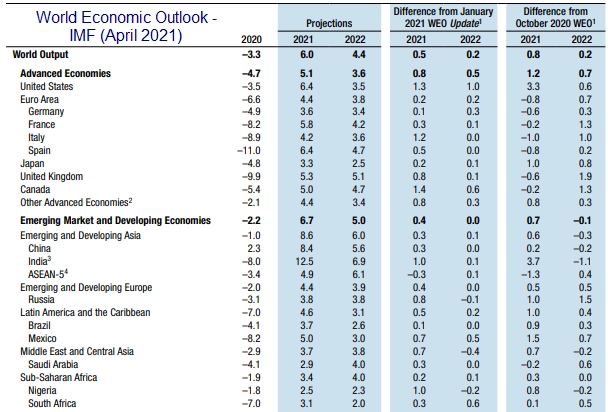

US equities edged down after their strong rally, but European equities kept on increasing, even erasing all their pandemic losses. Risk appetite was supported by further fall in bond yields, the US 10y even trading 10bp below its peak of last week, which looks a bit strange given the economic news flow in the US. The IMF revised its global growth forecasts higher, even for the euro area. The EUR/USD rebounded further near 1.1880, which also looks a bit premature. The release of the Fed minutes this evening will be the main event for markets today with services PMIs in Europe.

Get more analysis and data with our Premium subscription

Ask for a free trial here