Prices weakened again, slightly

European gas prices weakened again yesterday. Amid domestic fundamentals largely unchanged, the moderation in Asia JKM prices (-4.89%, to €103.426/MWh, on the spot; -0.36%, to…

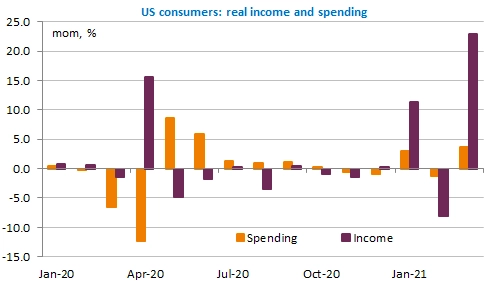

The EUR/USD exchange rate plunged by more than 1$ on Friday and is now trading just above 1.20. The preliminary estimates of Q1 GDP growth confirmed the double-dip recession in the euro area, while US March figures showed a record strong increase in personal income that foresees super strong growth in consumer spending for the months ahead. Moreover, a non-voting Fed member sent a noticeable warning about the Fed’s ultra-accommodative policy. Manufacturing PMI and ISM will be released today. Bank holiday in the UK.

Get more analysis and data with our Premium subscription

Ask for a free trial here