Join EnergyScan

Get more analysis and data with our Premium subscription

Ask for a free trial here

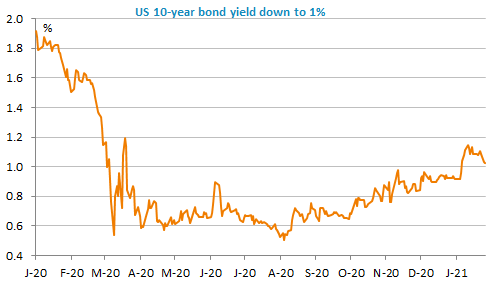

US tech stocks remain apart, but the general trend in financial markets has turned negative for two main reasons: 1) hopes of recovery linked to Covid vaccines have likely be excessively optimistic and 2) the US stimulus package will not be voted before mid-March at the earliest according to the Democratic majority leader of the Senate. US 10y bond yields are down and nearing 1% and the USD is strengthening again: the EUR/USD is trading around 1.2120 at the time of writing. The two-day Fed meeting starting today may be more important than thought initially to reassure markets.

Get more analysis and data with our Premium subscription

Ask for a free trial here

We will get back in touch with you soon.

Don’t forget to follow us on twitter!