Managing expectations

The latest Fed meeting did not surprise market consensus and implied market rates. Indeed, on many aspects, bond yields and interest rate futures were in…

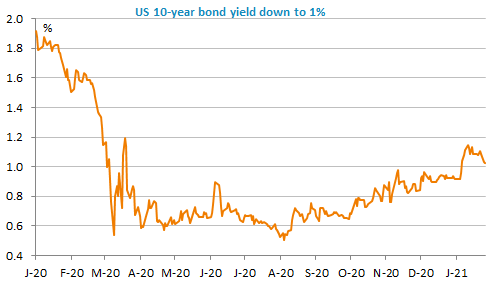

US tech stocks remain apart, but the general trend in financial markets has turned negative for two main reasons: 1) hopes of recovery linked to Covid vaccines have likely be excessively optimistic and 2) the US stimulus package will not be voted before mid-March at the earliest according to the Democratic majority leader of the Senate. US 10y bond yields are down and nearing 1% and the USD is strengthening again: the EUR/USD is trading around 1.2120 at the time of writing. The two-day Fed meeting starting today may be more important than thought initially to reassure markets.

Get more analysis and data with our Premium subscription

Ask for a free trial here