Sharp drop in European prices

European gas prices dropped significantly yesterday, both on the spot and the curve. With spot fundamentals almost unchanged, the bearish movement seems to have been…

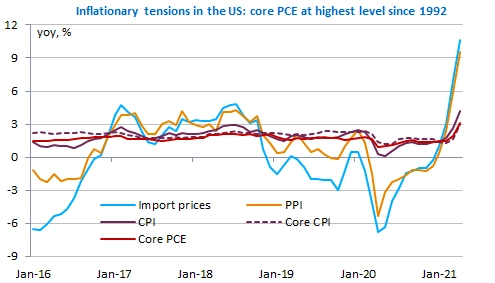

The Fed’s preferred measure of inflation accelerated to +3.1% yoy in April, but equities advanced further and the 10y bond yield fell below 1.6%. Markets still consider those tensions will remain transitory. The Chinese PMIs were solid in May, confirming the strengthening in domestic activity. By contrast, Japan looks closer to recession after weak retail sales and disappointing industrial output figures. The EUR/USD exchange rate remains rather stable near 1.22.

Get more analysis and data with our Premium subscription

Ask for a free trial here