Join EnergyScan

Get more analysis and data with our Premium subscription

Ask for a free trial here

US equity markets hit new highs yesterday, but futures flipped and Asian markets fell instead. The dollar is fairly stable around 1.1750, but bond yields are edging up with the US 10 year now at 1.33%. The economic reports have little impact before Jerome Powell’s speech scheduled for tomorrow in Jackson Hole.

Yesterday, the decline of the IFO index in Germany again highlighted the supply problems affecting the automotive sector in particular. The impact of the delta variant has been more moderate than in other European countries so far in Germany. Durable goods orders stagnated in July in the US and continue to trend downwards, which may reflect some uncertainty regarding corporate taxation.

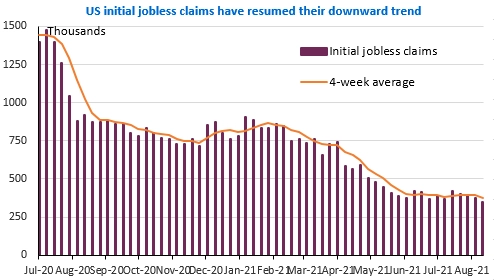

Today, US jobless claims and revised Q2 GDP growth figures (+6.5% according to first estimates).

Get more analysis and data with our Premium subscription

Ask for a free trial here