There is renewed concern

The US equity markets fell again yesterday, this time more sharply (-2% for the S&P 500 and -3% for the Nasdaq). The sharp decline in the…

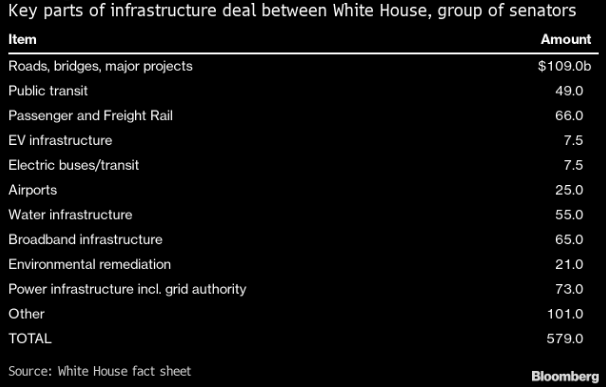

The White House has reached a deal with a bi-partisan group of Senators at the Senate on an infrastructure package including $579bn in new spending. This is far from the whole $2.3bn plan announced by Mr. Biden in March. Social spending could be part of another plan that Democrats will try to pass without the support of the Republican party. The equity market reacted positively to the news and reached new record-high levels in the US. The bond market posted no reaction. Fed speakers had no impact either. The USD was slightly down again. The EUR/USD exchange rate is now trading around 1.1940.

Get more analysis and data with our Premium subscription

Ask for a free trial here