Back to reality

The decline in long term bond yields was accentuated yesterday, pulling the US 10 year down to 1.43%, mainly on the idea that Joe Biden might decide to…

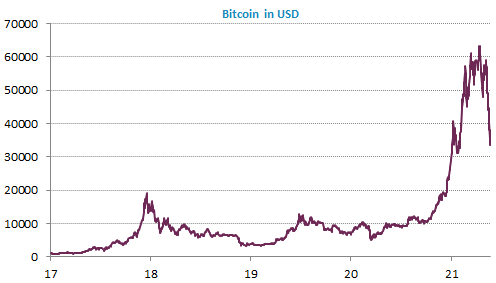

Volatility has been quite strong on financial markets last week, with the Fed minutes in the middle of the week and huge price variations on cryptocurrencies. Finally, they posted their worst week since the start of the pandemic last year. The setbacks of Bitcoin and its cronies may have impacted the other assets but the link is difficult to establish. The EUR/USD plunged on Friday despite very strong PMIs in the euro area, as the ECB’s chief suggested there would be no tapering in bond purchases I the near future. Bond spreads diminished as well in the euro area. The EUR/USD exchange rate is trading just below 1.22.

Get more analysis and data with our Premium subscription

Ask for a free trial here