European gas prices increased again yesterday

European gas prices increased again yesterday, still supported by cold weather and concerns on Nord Stream 2. The strength in Asia JKM prices (+6.47%, to…

Get more analysis and data with our Premium subscription

Ask for a free trial here

European gas prices hit new record highs on Wednesday with the TTF August 21 contract trading just below the €40/MWh mark while NBP August 21 prices breached the 100 p/th mark for the first time since 2008. On the far curve, TTF year-ahead prices hit a new eight-year high at €27/MWh. In Asia, JKM prices also breached the $15/MMBTU mark, tracking gains at the TTF on the back of steady summer demand.

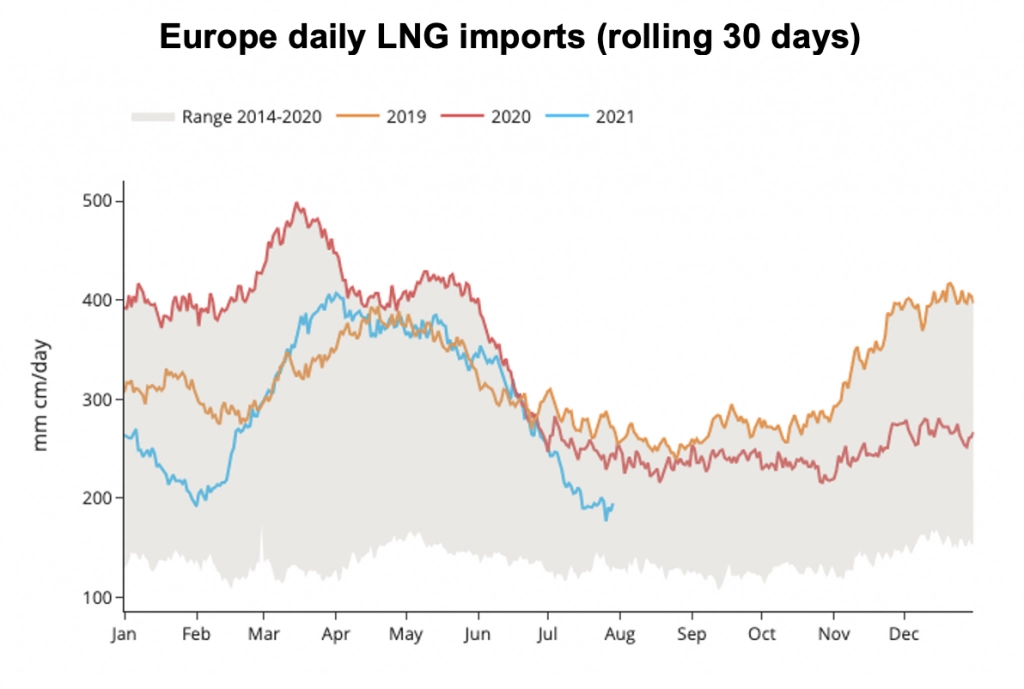

Low storage inventories and tight LNG supply to Europe (see below graph) due to fierce competition with Asian buyers should continue to fuel the bullish sentiment amid limited Russian gas transit through Ukraine. TTF front-month prices traded above the €40/MWh mark at the opening today. But with no specific news behind this new rally, risks of a downward correction are growing as most contracts at the TTF are approaching technical resistance levels and gas-to-power demand significantly dropped in July (-15% yoy in Western Europe so far).