Another day with an undecided market

Friday was a volatile session, with oil prices reverting at the end of the day: NYMEX front month WTI went down by 0.01% to end the…

Get more analysis and data with our Premium subscription

Ask for a free trial here

European gas prices dropped significantly yesterday, pressured by below-normal demand and technical correction, which outweighed the impact of lower Russian supply. Indeed, due to maintenance at Mallnow (landing point of the Yamal pipeline), Russian flows dropped to 266 mm cm/day yesterday, compared to 322 mm cm/day on Monday. As for Norwegian flows, they dropped very slightly to 328 mm cm/day on average, compared to 331 mm cm/day on Monday. The drop in coal and EUA prices (which pulled parity prices with coal for power generation lower) exerted additional downward pressure, particularly for curve prices.

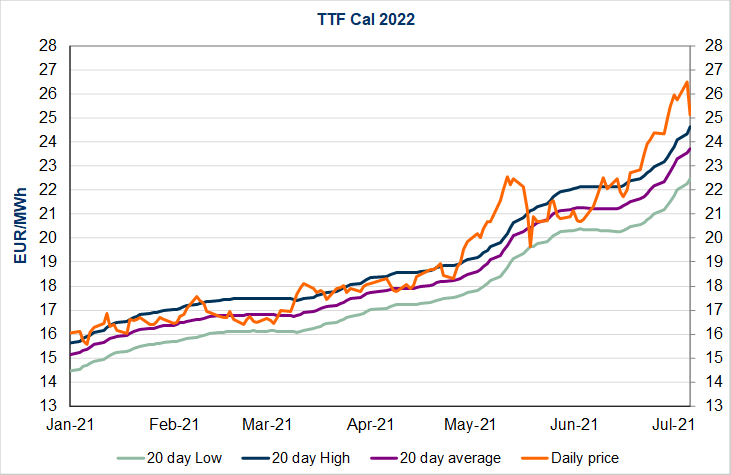

At the close, NBP ICE August 2021 prices dropped by 9.680 p/th day-on-day (-10.38%), to 83.540 p/th. TTF ICE August 2021 prices were down by 384 euro cents (-10.12%) at the close, to €34.105/MWh. On the far curve, TTF Cal 2022 prices were down by 136 euro cents (-5.14%), closing at €25.136/MWh.

Despite this sharp drop, TTF August 2021 prices are still above parity prices with coal for power generation (currently at €32.454/MWh). Prices could therefore continue to weaken today. However, low Russian flows and technical rebound could contribute to limit losses.