Optimism (almost) always wins in the end

Equity markets rebounded, bond yields edged down and the USD weakened: the impact of the Fed minutes has evaporated or maybe the markets are relieved…

Get more analysis and data with our Premium subscription

Ask for a free trial here

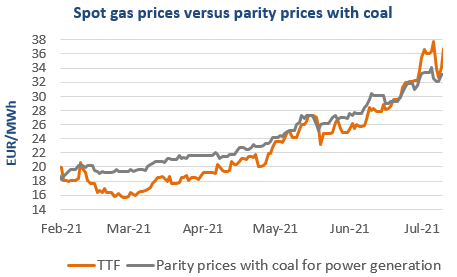

European gas prices increased sharply on Friday, mainly supported by the strong rise in Asia JKM prices (+13% on the spot, to €38.507/MWh). The rise in parity prices with coal for power generation (both coal and EUA prices were up) did not help calm the bullish pressure. On the pipeline supply side, Russian supply rebounded to 267 mm cm/day on average on Friday, compared to 248 mm cm/day on Thursday, following the restart of the Yamal pipeline. Norwegian flows increased to 333 mm cm/day on average, compared to 328 mm cm/day on Thursday.

At the close, NBP ICE August 2021 prices increased by 7.870 p/th day-on-day (+9.58%), to 90.020 p/th. TTF ICE August 2021 prices were up by 332 euro cents (+9.97%) at the close, to €36.632/MWh. On the far curve, TTF Cal 2022 prices were up by 118 euro cents (+4.69%), closing at €26.300/MWh.

Russian flows increased significantly over the week-end (to 326 mm cm/day) as the Yamal pipeline has fully returned from maintenance. Norwegian supply is also higher this morning (to 345 mm cm/day). This increase in supply could exert downward pressure on European gas prices today, particularly as they are now close to technically overbought levels.