When the bad can be good

A new record for the equity markets in New York, stable bond yields and a falling USD: the market is calmly awaiting the August employment report in…

Get more analysis and data with our Premium subscription

Ask for a free trial here

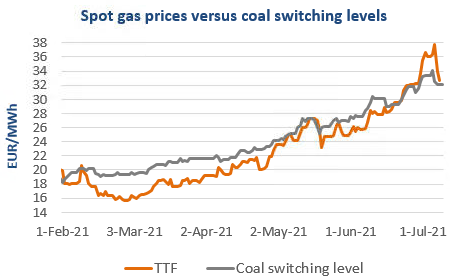

European gas prices continued to correct downward yesterday, further reducing their premium over parity prices with coal for power generation. They ignored the additional drop in Russian supply (248 mm cm/day on average yesterday, compared to 266 mm cm/day on Tuesday) due to the complete halt of flows to Mallnow (landing point of the Yamal pipeline) because of maintenance. Norwegian flows increased very slightly to 332 mm cm/day on average, compared to 328 mm cm/day on Tuesday. The drop in Asia JKM prices and in coal and EUA prices (which pulled parity prices with coal for power generation lower) exerted additional downward pressure, particularly for curve prices.

At the close, NBP ICE August 2021 prices dropped by 4.310 p/th day-on-day (-5.16%), to 79.230 p/th. TTF ICE August 2021 prices were down by 177 euro cents (-5.18%) at the close, to €32.338/MWh. On the far curve, TTF Cal 2022 prices were down by 52 euro cents (-2.09%), closing at €24.611/MWh.

With yesterday’s drop, TTF August 2021 prices are now close to parity prices with coal for power generation (currently at €32.100/MWh). Prices could therefore firm up a bit, particularly as they could also benefit from technical supports.