Join EnergyScan

Get more analysis and data with our Premium subscription

Ask for a free trial here

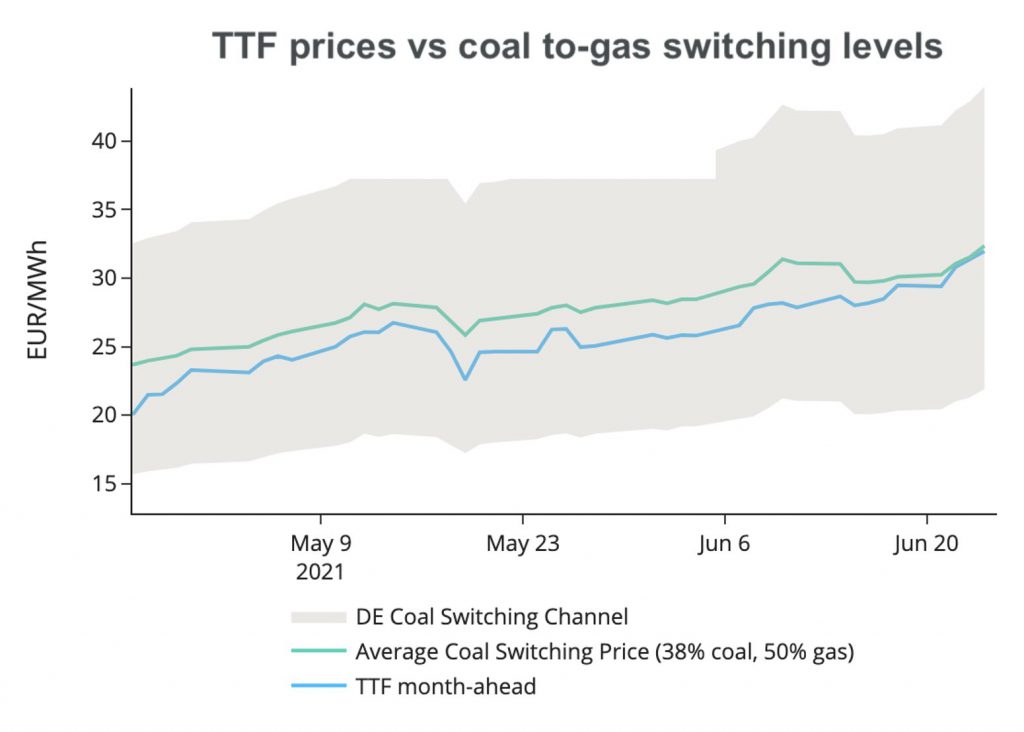

Despitesome intraday volatility, European gas prices continued to trend higher onThursday. A further rise in coal (new high for the API 2 Jul-21 contract) andEUA prices (first settlement above €55/t since mid-May for the Dec-21 contract)dragged EU gas-to-coal switching levels higher again. In Asia, buying tendersfor spot LNG volumes in China, Taiwan and Pakistan as well as steady Brentprices continued to fuel the bullish sentiment in JKM prices. With Norwegianimports flowing at only 244 mm cm/day yesterday (compared to around 350 mmcm/day of technical capacity) due to seasonal maintenance (although its impactwill diminish in the coming days), low LNG sendouts due to ongoing plannedoutages at import terminals, low stock levels, prospects of tight Russian gassupply with Yamal and Norsdtream 1 shutdowns and potentially no upside inUkrainian transit in July, the supply picture remains tight in the short-term.

Get more analysis and data with our Premium subscription

Ask for a free trial here