Join EnergyScan

Get more analysis and data with our Premium subscription

Ask for a free trial here

European gas prices were mixed yesterday, unable to find a strong driver. Asia JKM prices and parity prices with coal for power generation, which tend to set the ceiling and the floor for European prices respectively, sent mixed signals, up for the former, down slightly for the latter.

On the pipeline supply side, Russian flows dropped slightly yesterday, averaging 311 mm cm/day (compared to 314 mm cm/day on Tuesday). Norwegian flows were stable, at 317 mm cm/day on average.

Unsurprisingly, the Dusseldorf Higher Regional Court rejected Nord Stream 2 AG’s appeal for derogation and confirmed that the pipeline section in German territorial waters will have to follow regulations relating to third-party access rules, requirements on transparent tariffs and legal unbundling of transportation and production operations.

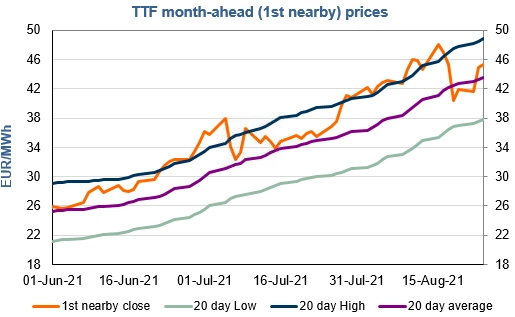

At the close, NBP ICE September 2021 prices increased by 2.030 p/th day-on-day (+1.82%), to 113.330 p/th. TTF ICE September 2021 prices were up by 41 euro cents (+0.92%) at the close, to €45.285/MWh. On the far curve, TTF Cal 2022 prices were down by 14 euro cents (-0.43%), closing at €31.802/MWh, above the coal parity price (€30.951/MWh).

Fundamentals should remain unchanged today. Therefore, after prices reached yesterday their short term technical resistances (or objectives), profit taking could pull them lower today. However, technical supports (€43.813/MWh on TTF September 2021 and €31.292/MWh on TTF Cal 2022) could contribute to limit losses.

Get more analysis and data with our Premium subscription

Ask for a free trial here