Join EnergyScan

Get more analysis and data with our Premium subscription

Ask for a free trial here

European gas prices were mixed yesterday, torn between the impacts of technical rebound after last week’s strong losses and a more comfortable outlook for Russian supply. The rise in Asia JKM prices and in parity prices with coal for power generation (both coal and EUA prices were up) provided support, particularly for curve prices.

On the pipeline supply side, Russian flows increased yesterday, averaging 295 mm cm/day (compared to 283 mm cm/day last Friday), thanks to higher Yamal flows to Mallnow. Norwegian flows were also up, averaging 320 mm cm/day, compared to 307 mm cm/day last Friday.

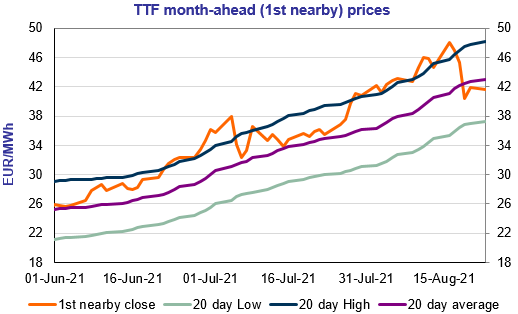

At the close, NBP ICE September 2021 prices dropped by 1.550 p/th day-on-day (-1.48%), to 103.210 p/th. TTF ICE September 2021 prices were down by 26 euro cents (-0.63%) at the close, to €41.680/MWh. On the far curve, TTF Cal 2022 prices were up by 25 euro cents (+0.81%), closing at €30.580/MWh, slightly above the coal parity price (€30.205/MWh).

European gas prices could tempt to continue their technical rebound today. But the bearish impact of the upcoming start of the Nord Stream 2 pipeline and technical resistances (€43.161/MWh on TTF September 2021 and €30.605/MWh on TTF Cal 2022) could continue to exert downward pressure.

Get more analysis and data with our Premium subscription

Ask for a free trial here