Prices increased again, more moderately

European gas prices increased slightly yesterday as the bullish impact of concerns on Russia-Ukraine tensions was partly offset by moderate demand, ongoing strong LNG sendouts…

Get more analysis and data with our Premium subscription

Ask for a free trial here

European spot gas prices increased yesterday, supported mainly by lower Norwegian supply. Indeed, Norwegian flows were significantly down, averaging 275 mm cm/day, compared to 309 mm cm/day on Friday, due to an unplanned outage at the Troll field. By contrast, Russian supply jumped to 331 mm cm/day on average (compared to 271 mm cm/day on Friday) as Nord Stream 1 flows gas flows returned to normal after planned maintenance. Curve prices were also up as the rise in oil prices, Asia JKM prices and parity prices with coal for power generation (both EUA and coal prices were up) has raised both their ceiling price and their floor price.

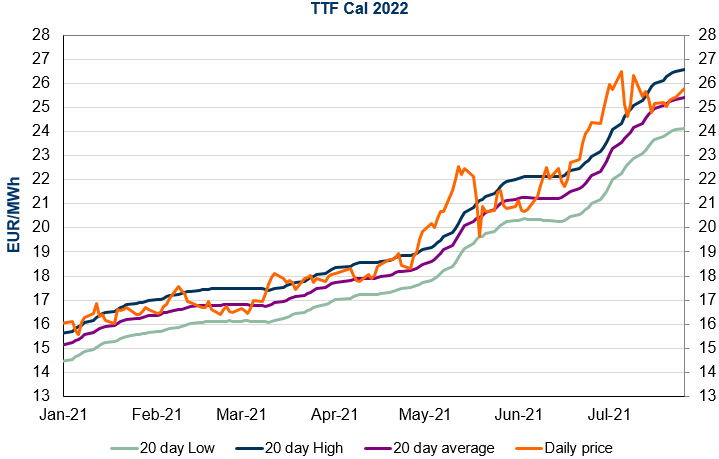

At the close, NBP ICE August 2021 prices increased by 4.550 p/th day-on-day (+5.14%), to 92.990 p/th. TTF ICE August 2021 prices were up by 139 euro cents (+3.92%) at the close, to €36.914/MWh. On the far curve, TTF Cal 2022 prices were up by 39 euro cents (+1.55%), closing at €25.790/MWh.

Today, the market will take an interest in the auction for interruptible capacity through Ukraine. But this auction is likely not to allocate any rights for additional transport of Russian gas in August as was the case in the last 10 such monthly offerings. European gas prices could therefore continue to increase, particularly as Norwegian supply is expected to remain low due to planned maintenance works at Troll. However, technical resistances (€37.423/MWh on TTF August 2021 and €26.057/MWh on TTF Cal 2022) could contribute to limit gains.