More clouds on the growth horizon

Concerns over the ongoing economic slowdown are growing among financial markets. In the US, the Nasdaq index plunged on Friday by more than 4% on the back…

Get more analysis and data with our Premium subscription

Ask for a free trial here

European gas prices dropped yesterday, pressured by lower demand and profit taking. They even ignored the drop in pipeline supply. Indeed, Russian supply dropped to 163 mm cm/day on average yesterday, compared to 310 mm cm/day on Monday, as the Nord Stream 1 gas pipeline was shut for a 10-day planned maintenance from Tuesday 13 July. Norwegian flows dropped to 328 mm cm/day on average, compared to 342 mm cm/day on Monday.

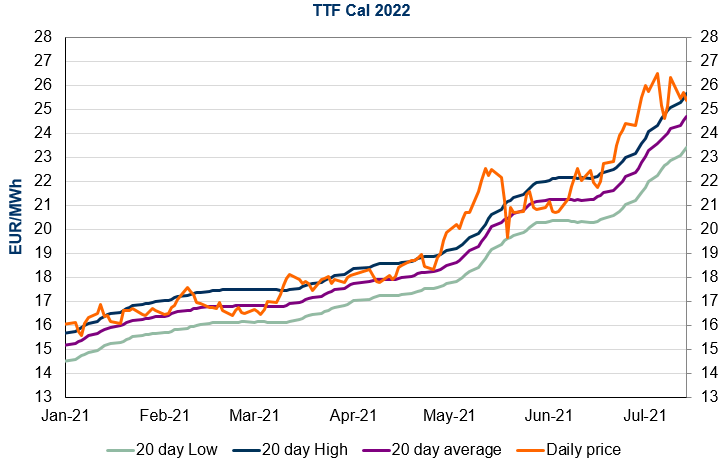

At the close, NBP ICE August 2021 prices dropped by 1.800 p/th day-on-day (-2.07%), to 85.290 p/th. TTF ICE August 2021 prices were down by 69 euro cents (-1.94%) at the close, to €34.775/MWh. On the far curve, TTF Cal 2022 prices were down by 31 euro cents (-1.20%), closing at €25.361/MWh.

European gas prices could continue their technical correction today. However, given the weak Russian supply, losses should be limited.