Crude oil prices rebound sharply after sanctions against Russia are stepped up

As explained in the Daily Eco, the EU and the US have stepped up the pressure on Russia by significantly tightening their sanctions against banks and,…

Get more analysis and data with our Premium subscription

Ask for a free trial here

Prices weakened again yesterday in most European gas markets, pressured by lower demand and technical selling (on the back of lower oil prices). On the pipeline supply side, Russian flows remained stable at 163 mm cm/day on average yesterday, with the Nord Stream 1 gas pipeline still shut for a 10-day planned maintenance that started on 13 July. Norwegian flows were almost stable, averaging 327 mm cm/day, compared to 328 mm cm/day on Wednesday.

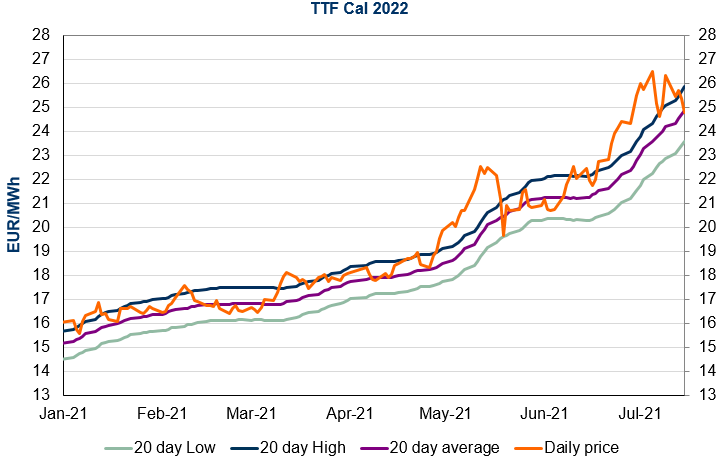

At the close, NBP ICE August 2021 prices dropped by 2.160 p/th day-on-day (-2.53%), to 83.130 p/th. TTF ICE August 2021 prices were down by 98 euro cents (-2.81%) at the close, to €33.797/MWh. On the far curve, TTF Cal 2022 prices were down by 57 euro cents (-2.25%), closing at €24.791/MWh.

The price drop yesterday was blocked by the 20-day average (€33.554/MWh on TTF August 2021 and €24.837/MWh on TTF Cal 2022). This 20-day average could continue to set a floor to prices today, particularly as Norwegian supply is expected to drop due to a planned maintenance on the Troll gas field.