Ever higher

Global stocks continue to rise and so do commodity prices and bond yields, while the Bitcoin is nearing $50000. Risky assets are pushed higher by…

Get more analysis and data with our Premium subscription

Ask for a free trial here

European gas prices rebounded yesterday, supported by the increase in oil and Asia JKM prices and technical buying. The rise in parity prices with coal for power generation (both EUA and coal prices were up) also exerted upward pressure. On the pipeline supply side, Russian flows were almost stable at 162 mm cm/day on average yesterday (compared to 163 mm cm/day on Tuesday), as the Nord Stream 1 gas pipeline is still shut for a 10-day planned maintenance that started on 13 July. Norwegian flows were slightly down, averaging 320 mm cm/day, compared to 323 mm cm/day on Tuesday.

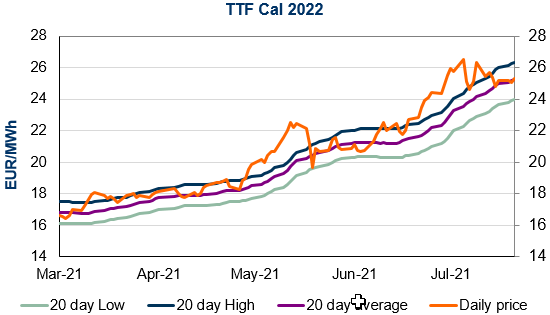

At the close, NBP ICE August 2021 prices increased by 2.030 p/th day-on-day (+2.32%), to 89.680 p/th. TTF ICE August 2021 prices were up by 78 euro cents (+2.23%) at the close, to €35.949/MWh. On the far curve, TTF Cal 2022 prices were up by 26 euro cents (1.03%), closing at €25.301/MWh.

Low stock levels, weak pipeline supply and strong Asia JKM prices remain supportive for European gas prices and additional gains are likely. However, profit taking and technical resistances (€36.668/MWh on TTF August 2021 and €25.511/MWh on TTF Cal 2022) could however contribute to limit gains today.