Join EnergyScan

Get more analysis and data with our Premium subscription

Ask for a free trial here

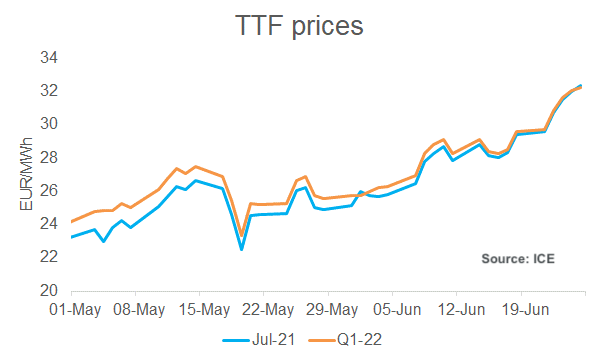

European gas prices ended the week on another bullish note on Friday, supported by the delayed start-up of production at the Asgard field in Norway after seasonal maintenance (15 mm cm/day impact), low wind power generation and a further drop in LNG regas flows from NW Europe import terminals. The TTF ICE July-21 contract settled just above the Q1-22 contract at the close in a very unusual move. Strong oil and coal prices (new 2021 highs for Brent and API 2 benchmarks) pushed contracts further high as well on the far curve. As a reminder, you’ll find here our summary of the key elements behind this historical jump in global gas prices (for premium users only).

Get more analysis and data with our Premium subscription

Ask for a free trial here