Join EnergyScan

Get more analysis and data with our Premium subscription

Ask for a free trial here

Get more analysis and data with our Premium subscription

Ask for a free trial here

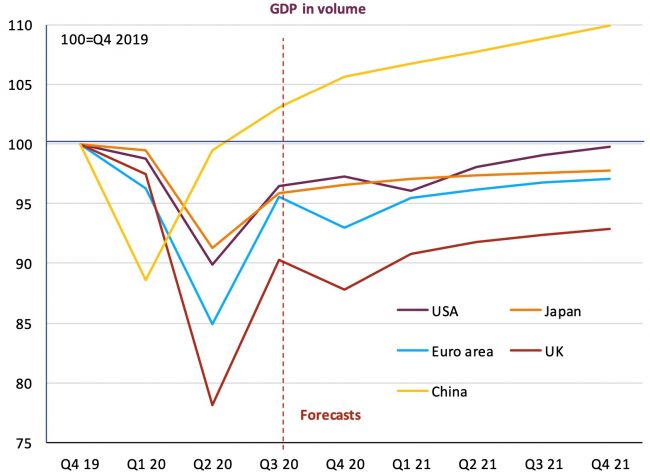

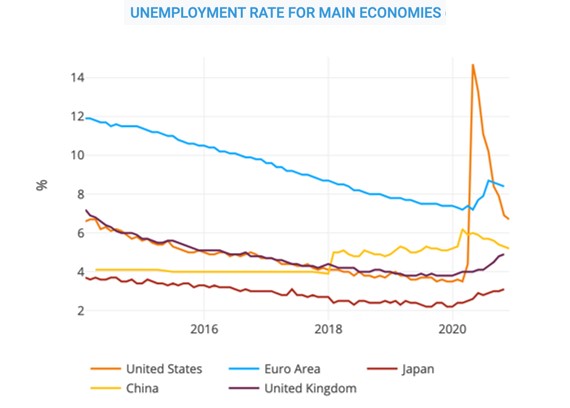

Indeed, whereas the growth momentum looks strong in China, the pandemic should continue to keep a lid on economic activity in the US and in Europe in 2021 after the disaster of 2020. It appears clearly that the size of the impact of the pandemic on health systems in 2020 is negatively correlated to the speed of the recovery in 2021. Finally, the Covid crisis will leave most countries with massive indebtedness and high unemployment rate at least until 2022.

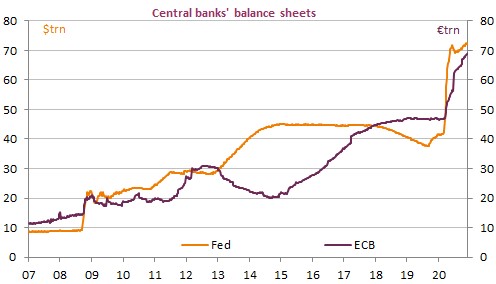

But government and central banks should remain particularly supportive after historical interventions in 2020 (see balance sheet chart below), taking advantage of the ultra-low level of interest rates that has reduced considerably the cost of additional debt.

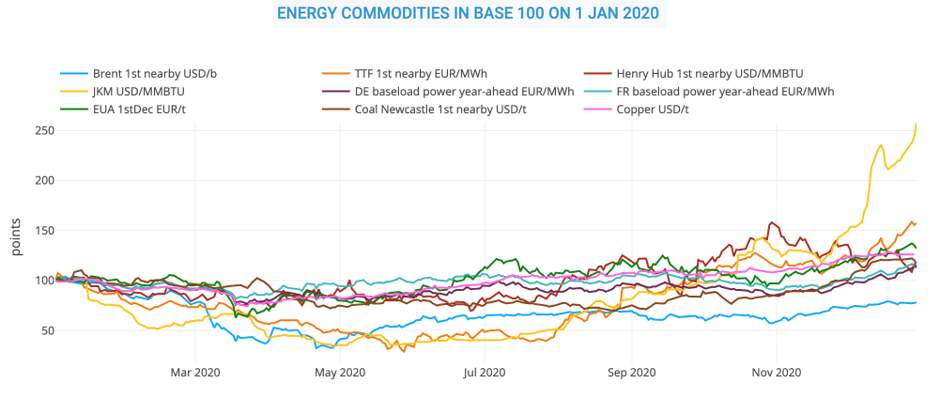

Thanks to a year-end rally, most energy prices will end 2020 at higher levels than January (and even twice higher for Asian LNG prices) before hitting record lows in Q2-20 as energy demand plunged on the back of multiple COVID-19 lockdowns across the globe which cut consumption from industrial, commercial and transport users.

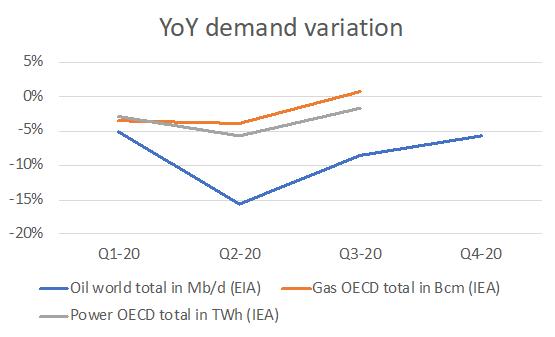

Nevertheless, the impact was clearly less significant for power and natural gas demand compared to oil (see chart) and the recovery from Q3-20 is also slower for oil, notably due to prolonged travel restrictions across the globe. As a consequence, oil prices still remain 20% below their year-opening level in late December.

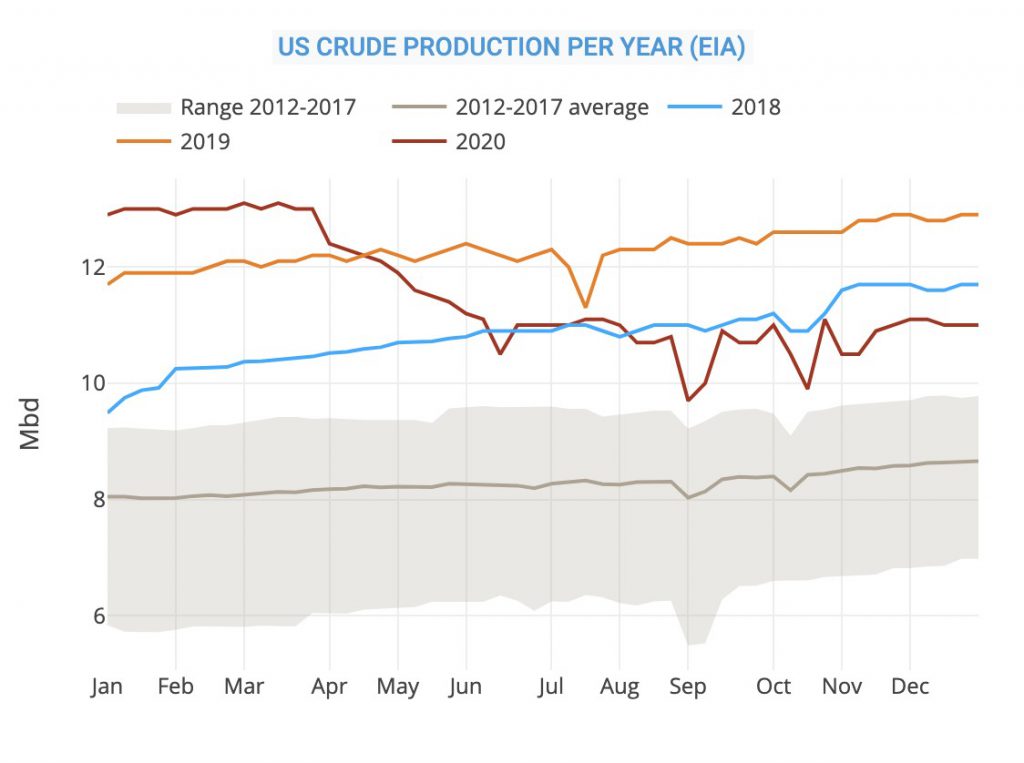

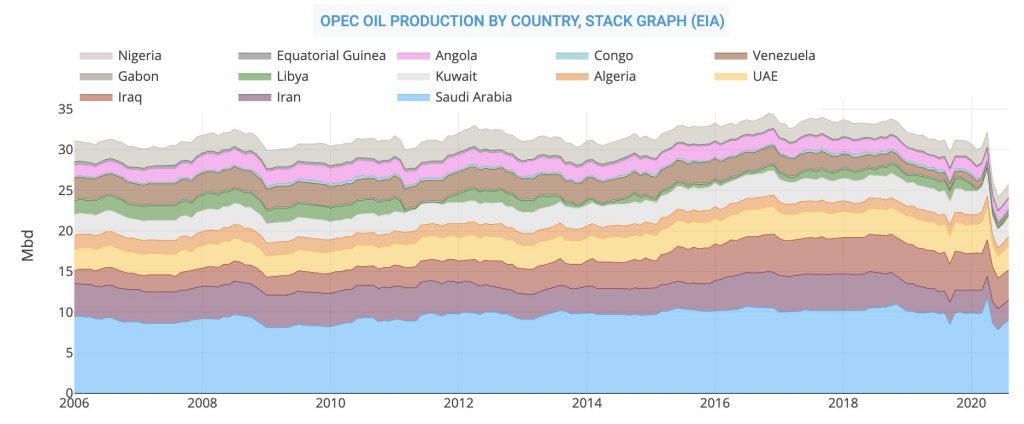

Massive oil and gas supply cuts also played a key role. On the oil side, OPEC producers were back into the fore with historical output cuts while US shale oil producers may be durably hit by the plunge in WTI prices (even into negative territory in May). Most US shale oil producers cut investments in 2020, which could lead to a tightening of the global oil balance as soon as 2021 if demand recovers to its pre-crisis level. Overall, we believe that oil prices could show a bigger upward potential than the rest of the energy complex next year, owing to their current recovery delay.

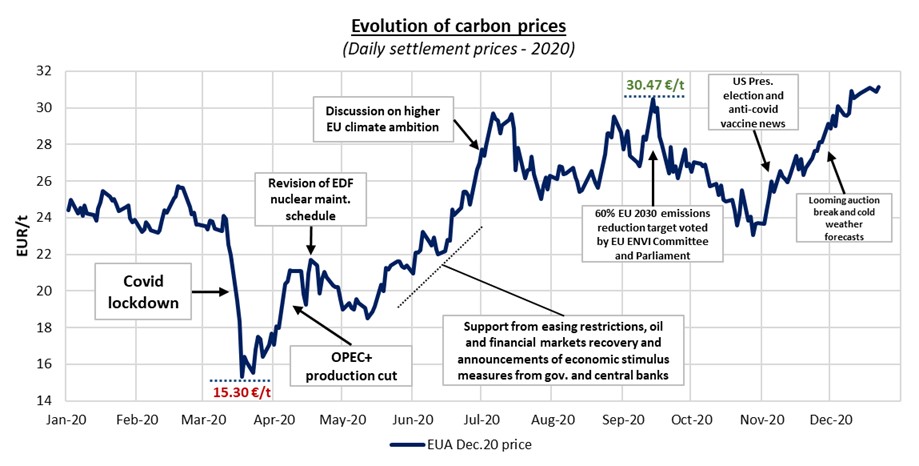

Nevertheless, in the medium term EUA prices could continue to observe a high volatility with the startup of the Phase IV in 2021 as market players wait for the European Commission proposals on the EU ETS review scheduled in June 2021. Brexit developments and a potential worsening of the health situation regarding the Covid-19 pandemic could also inject some volatility in early 2021. Meanwhile, the auction supply will remain heavy with the Market Stability Reserve absorbing part of the surplus generated by the Covid-19 crisis only from September 2021. A slow economic recovery might have a long-term impact as well on the demand for allowances from industrial and power sectors.

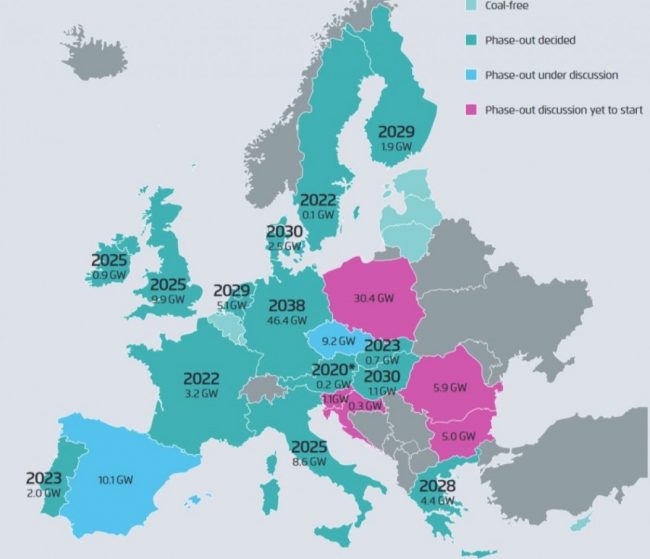

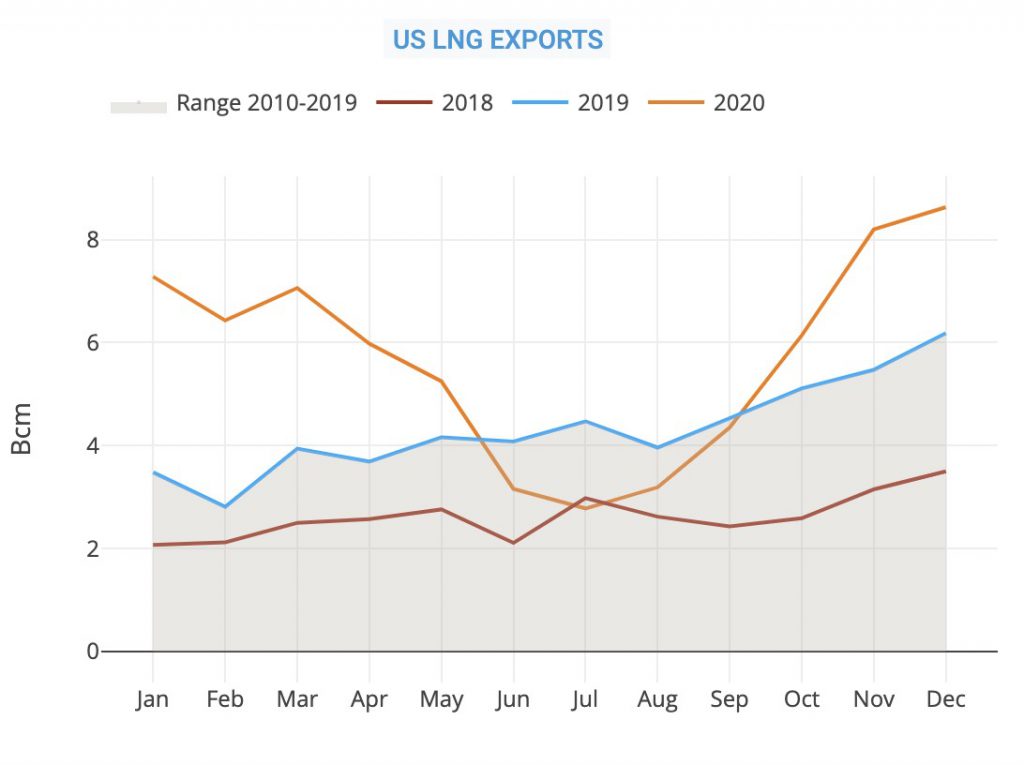

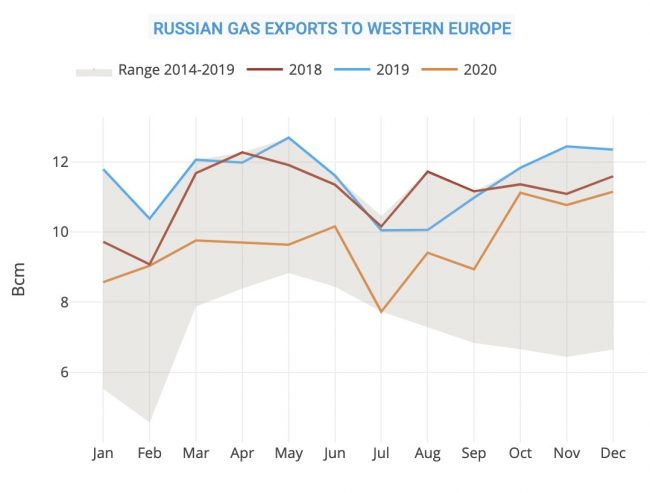

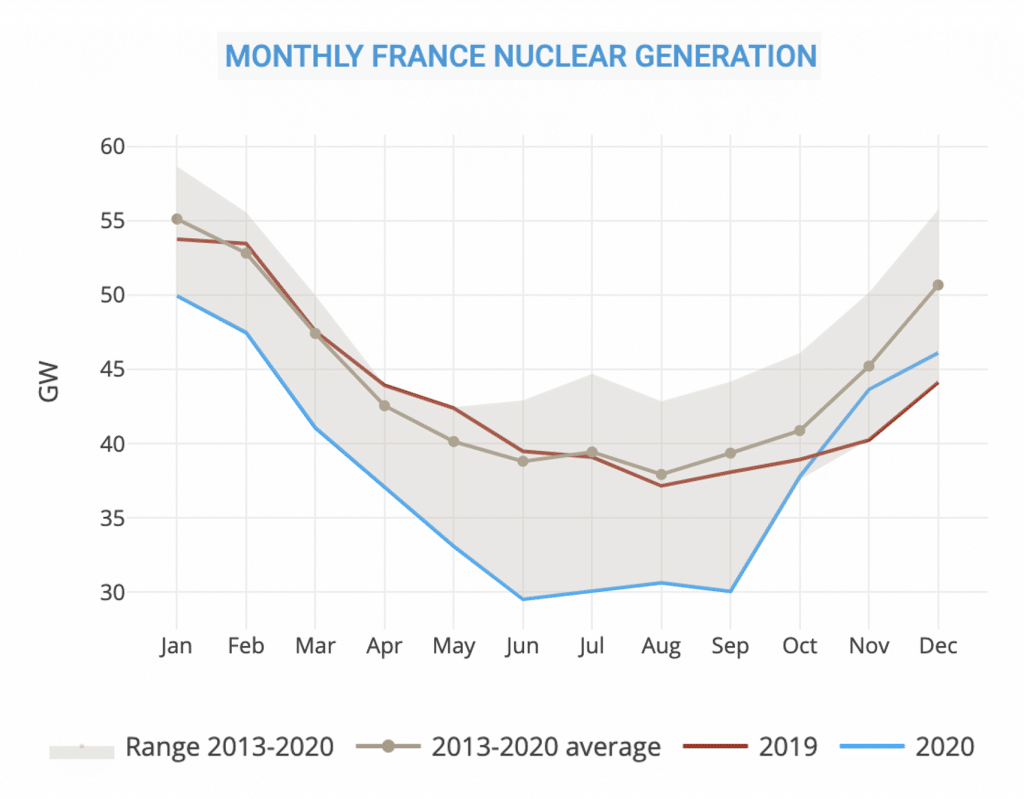

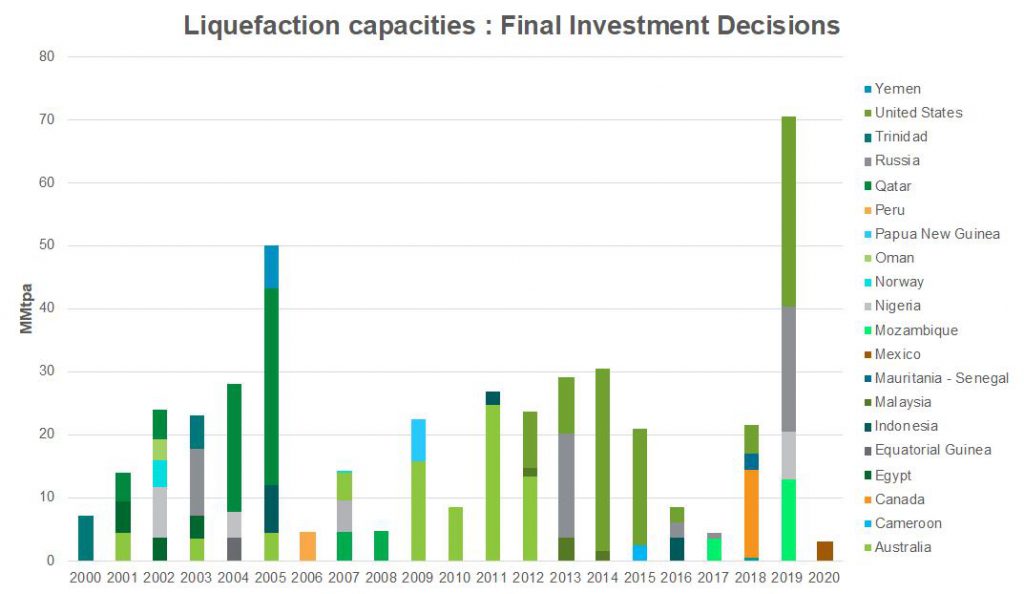

2021 could see a rebound in LNG FIDs as Asian LNG prices jumped to a six-year high in December due to a combination of steady industrial demand in China, cold weather, tight shipping capacity and multiple supply issues. But a tightening of global LNG markets cannot be excluded in the short term if the economic recovery continues and keeps gas demand growth at a steady level in northeast Asia, especially in China. Nuclear and coal phase out plans in Europe could also keep gas-for-power demand steady. On the supply side, we should not see any significant additional liquefaction capacity before 2024, with a second wave of new liquefaction capacities mostly from the US and Qatar. But most additional trains should come after 2025.