European energy prices are ending 2021 with another bullish rally: TTF Jan-22 prices are back above the €100/MWh mark, EUA Dec-21 prices are trading at new record highs just below €90/ton and French Cal 2022 power prices are now trading above the €200/MWh level.

Here are five key elements (and associated charts) to understand current market dynamics.

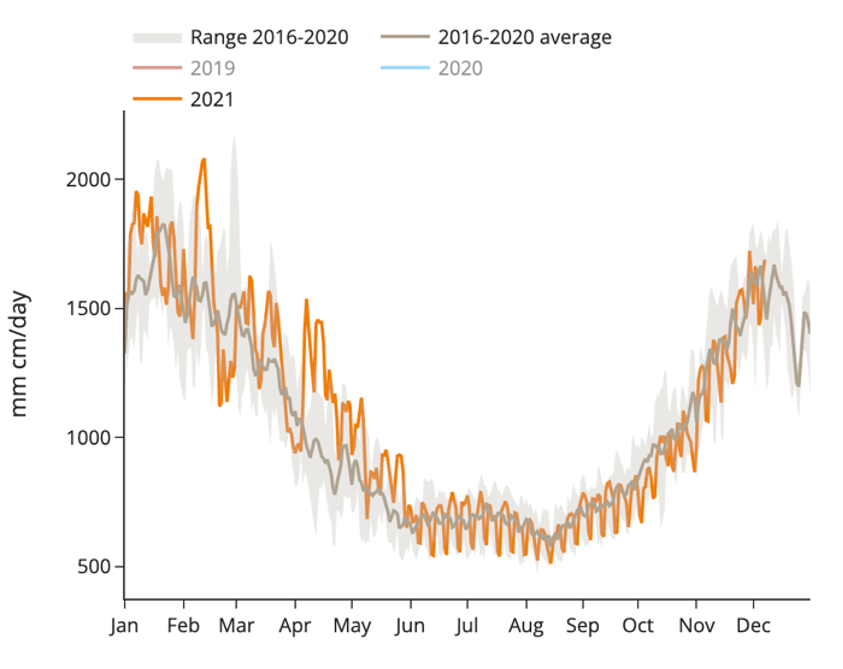

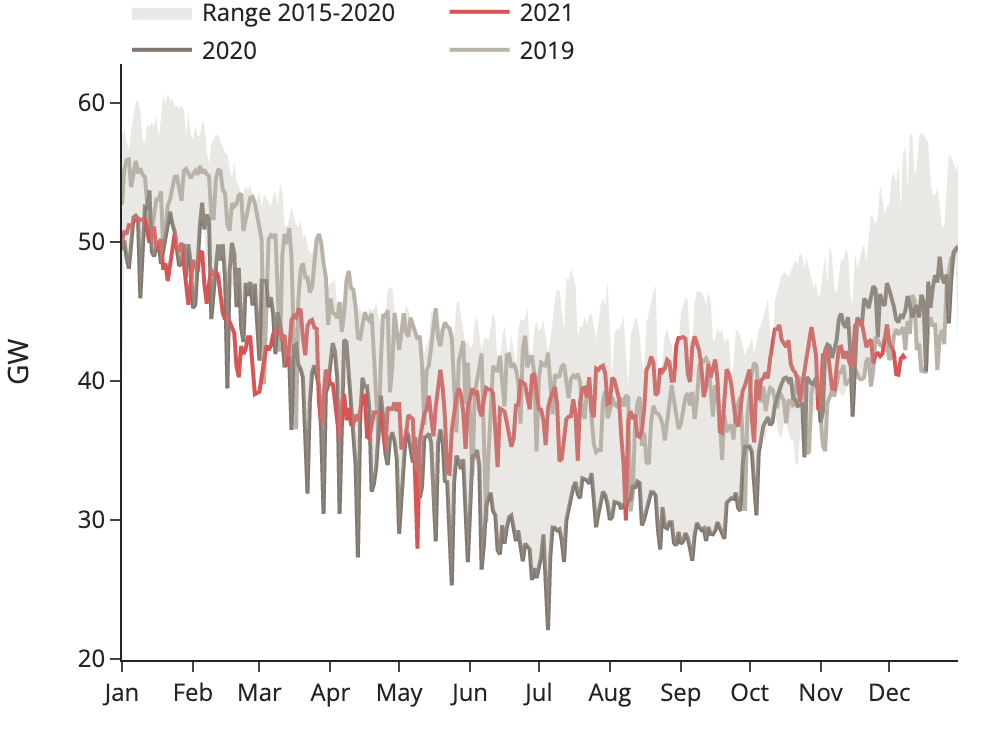

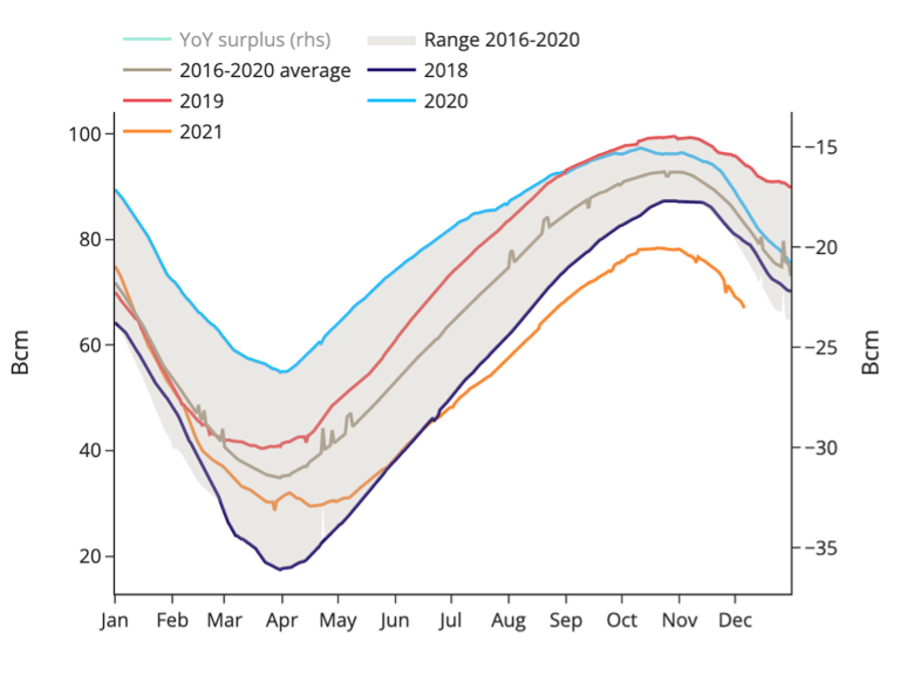

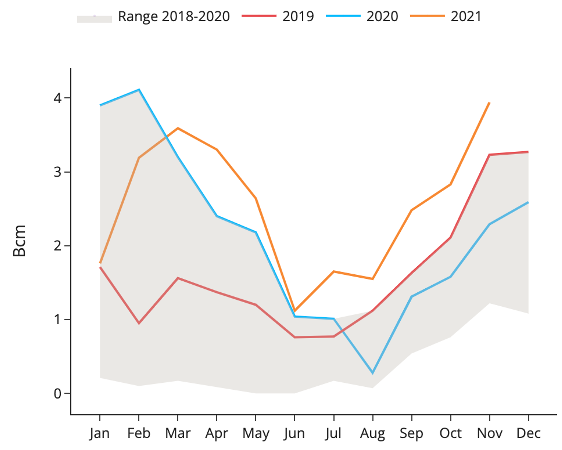

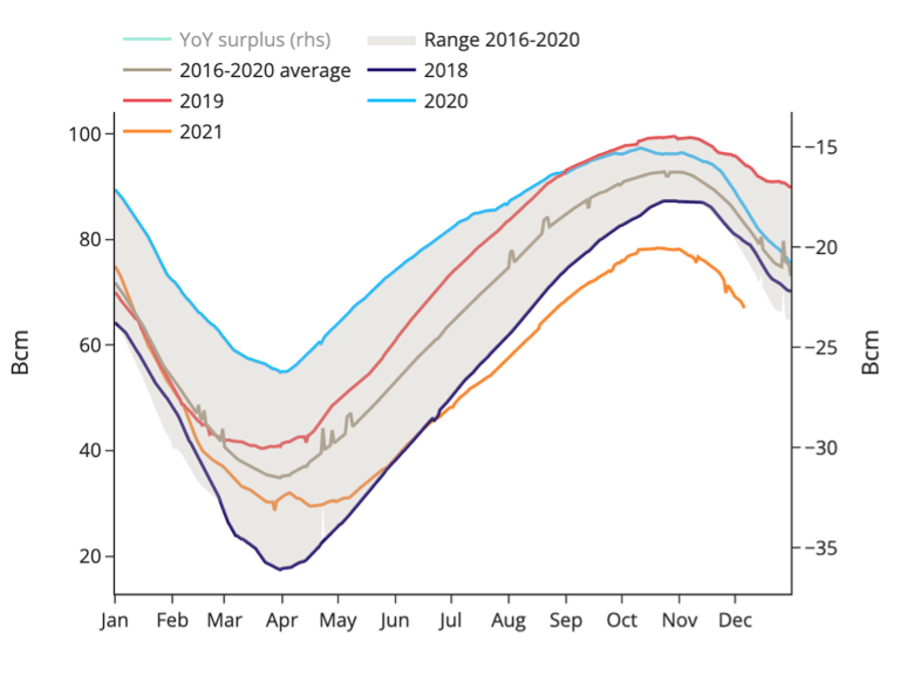

- With finally limited gas demand destruction despite record high prices and no major change in pipeline supply flows over the past few weeks, European gas stocks are dwindling at a steady pace with a 16 Bcm deficit compared to the five-year average level for early December. Every supply shock or concern over future supply flows (unplanned outages, geopolitical tensions between US and Russia) just fuels the bullish sentiment at this point in the absence of a prolonged mild weather period so far this winter.

Europe gas stock levels

(AT, BE, BG, CZ, DE, FR, HR, HU, IT, NL, PL, PT, RO, SK, SP, UK)

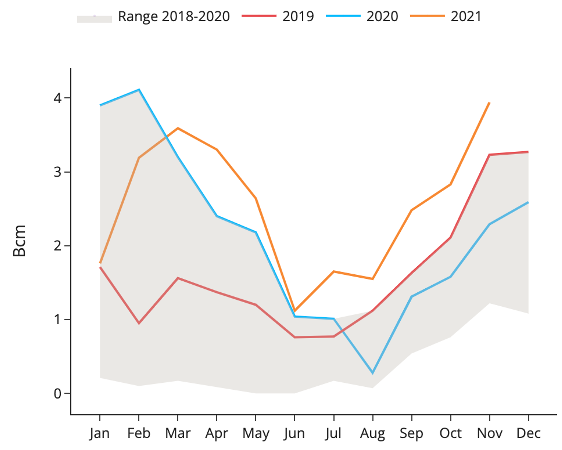

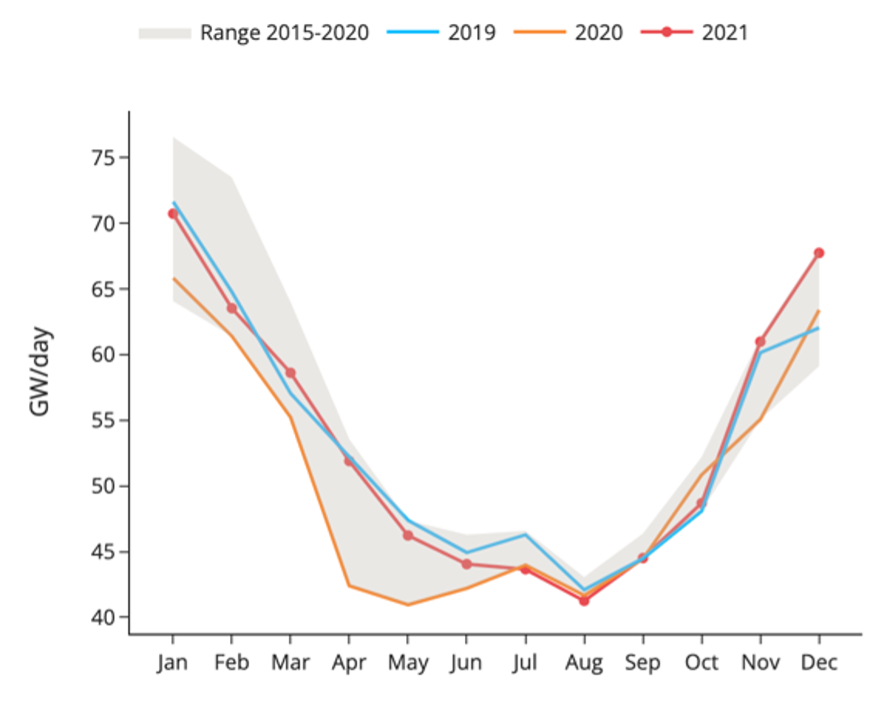

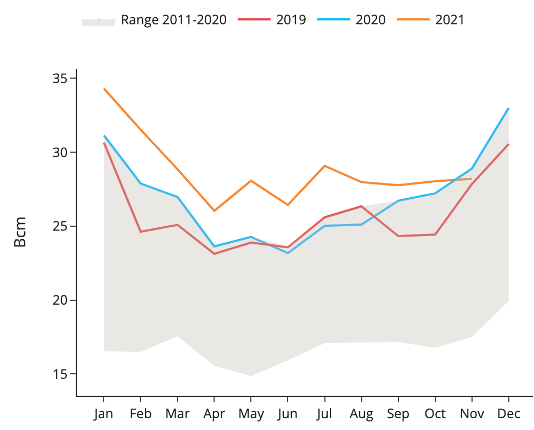

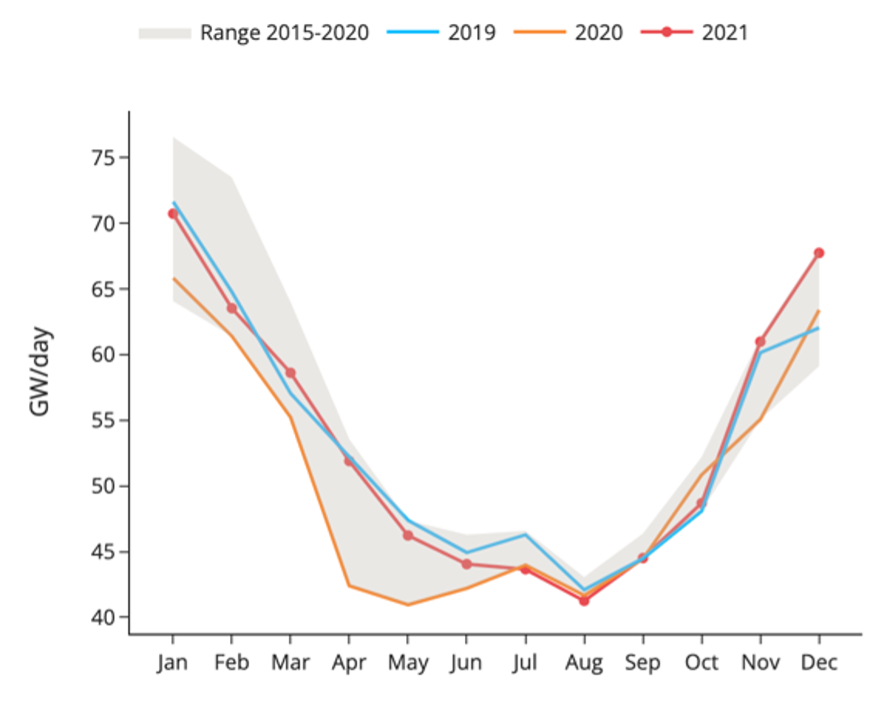

![]() Western Europe gas demand

Western Europe gas demand

GB, FR, NL, DE, BE, ES, IT, PT, AT, CZ, SK

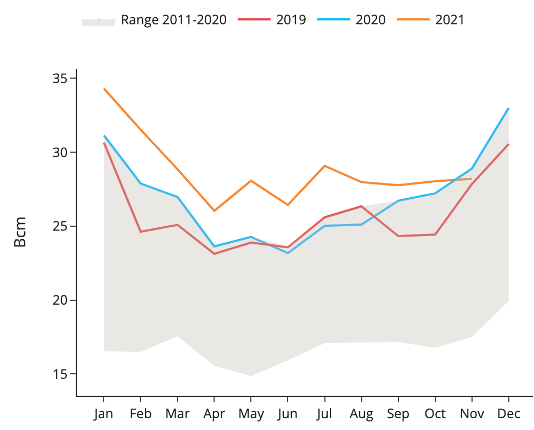

- The only positive element on the European gas supply side is the progressive increase in LNG imports (notably from the US) thanks to strong LNG production levels and a (temporary?) slowdown in Asian LNG demand on the back of healthy LNG stock levels, rising Japanese nuclear power generation and lower price-sensitive imports in India.

US LNG exports to Europe

(source : KPLER)

Main Asian LNG imports

(source : KPLER)

- The surge in EUA prices looks rather correlated to speculative moves than tight fundamentals and risks of a technical correction are growing every day ahead of the Dec-21 contract expiry on 20 Dec.

Technical analysis on EUA Dec-21 prices

(source : Refinitiv)

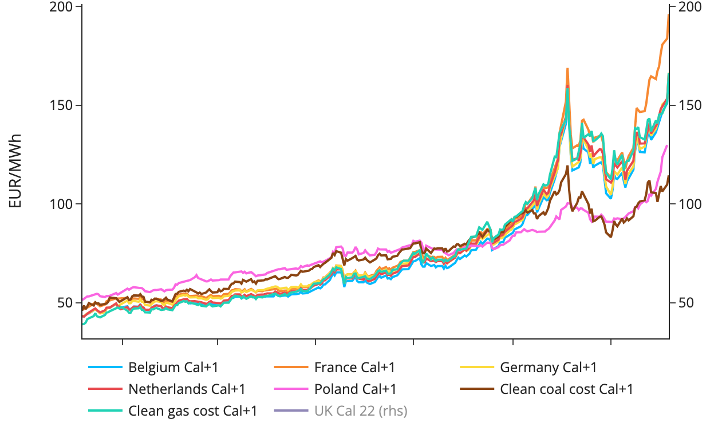

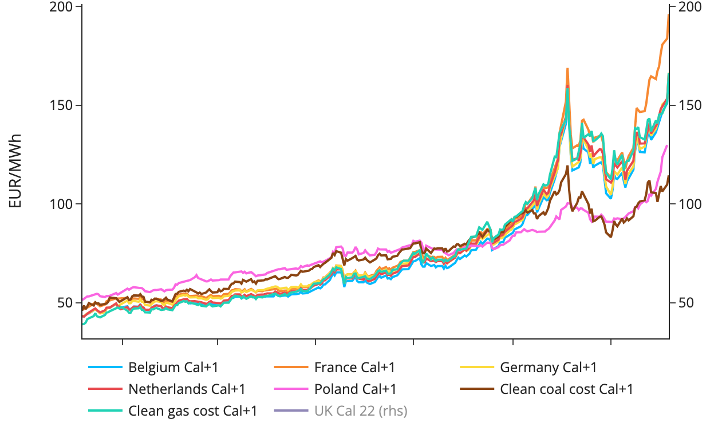

- European power prices continue to bear the impact of rising marginal production costs from gas-fired power plants which generation is not altered by record high gas prices.

Baseload year-ahead power prices

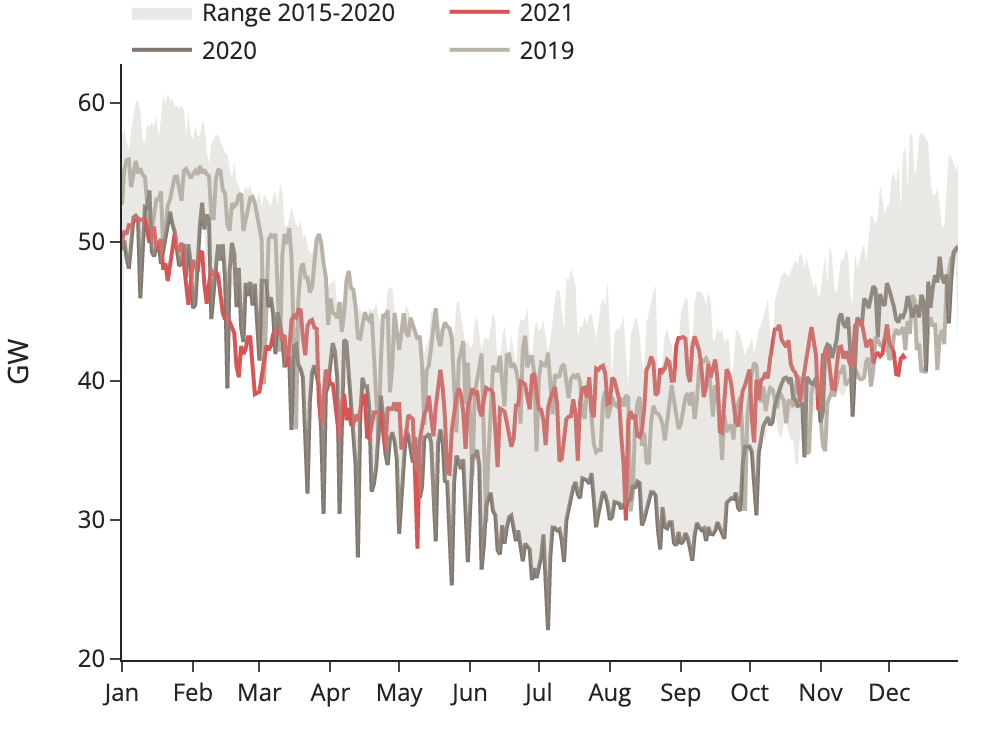

- The combination of strong heating demand and limited nuclear generation are particularly supporting French power prices both at spot and forward levels, with notably strong power imports requirements now to balance the French power system.

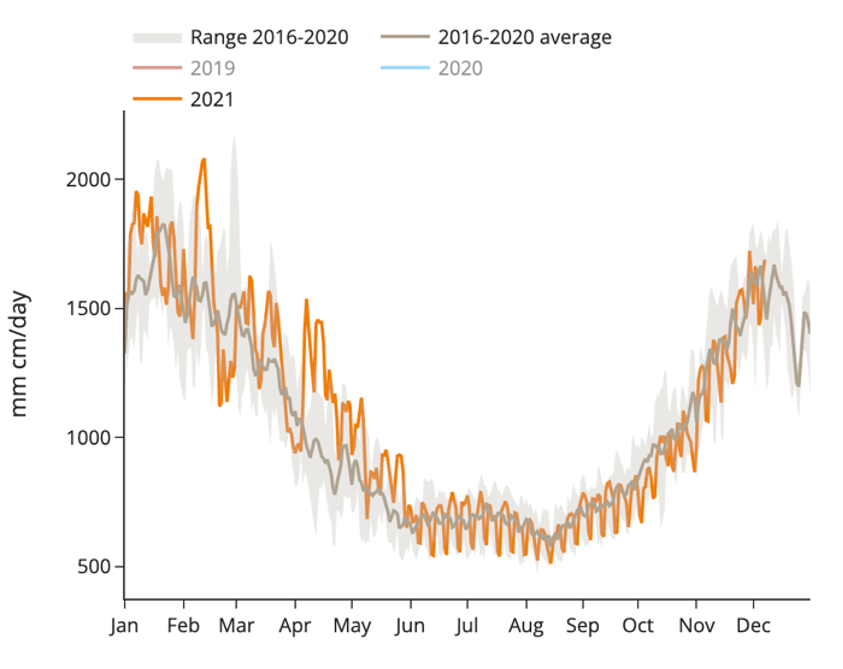

France nuclear generation

(source: RTE)

France average power load

(source: ENTSOE)

Western Europe gas demand