Join EnergyScan

Get more analysis and data with our Premium subscription

Ask for a free trial here

European gas prices increased strongly yesterday, continuing their technical rebound as many market participants preferred to close their short positions in anticipation of a German-court ruling on the Nord Stream 2 pipeline. The rise in Asia JKM prices (+3.06% on the spot, to €47.752/MWh) and in parity prices with coal for power generation (both coal and EUA prices were up) did not help calm the upward pressure.

On the pipeline supply side, Russian flows increased again yesterday, averaging 314 mm cm/day (compared to 295 mm cm/day on Monday), thanks to higher Yamal flows to Mallnow. Norwegian flows were slightly down, averaging 317 mm cm/day (compared to 320 mm cm/day on Monday), due to unplanned outages.

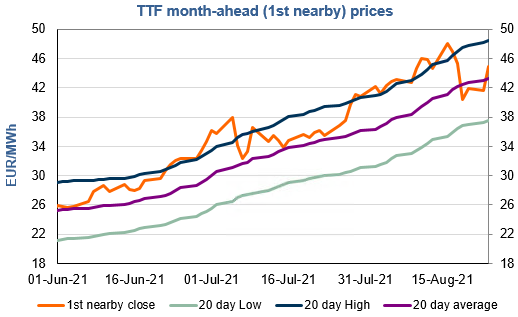

At the close, NBP ICE September 2021 prices increased by 8.090 p/th day-on-day (+7.84%), to 111.300 p/th. TTF ICE September 2021 prices were up by 319 euro cents (+7.65%) at the close, to €44.870/MWh. On the far curve, TTF Cal 2022 prices were up by 136 euro cents (+4.45%), closing at €31.940/MWh, above the coal parity price (€31.008/MWh).

Today, the market will closely monitor the Dusseldorf Higher Regional Court’s ruling on the German section of the Nord Stream 2 gas pipeline as to whether or not it can be exempt from ownership and third-party access rules after Nord Stream 2 AG appealed the original decision. This could create higher volatility, but the risk seems to be on the downside, particularly as prices could face some strong technical resistances (€45.689/MWh on TTF September 2021 and €31.958/MWh on TTF Cal 2022).

Get more analysis and data with our Premium subscription

Ask for a free trial here