Join EnergyScan

Get more analysis and data with our Premium subscription

Ask for a free trial here

ICE Brent front-month contract rallied back to 71 $/b yesterday, with the Oct/Nov time spread climbing a high as 75 cents, from 40 cents the day prior. We believe the front-month contract’s fair value remains close to 70 $/b, given the dollar strength and how time spreads rallied strongly from their previous values. PEMEX brought clarity about the outage in their offshore crude production, by anticipating a complete recovery of the production by Aug 30th. This represents 4 mb of lost production in the Gulf of Mexico. If we account for the 20 mb US SPR sour crude stock release announced earlier this week, the region remains adequately supplied. According to the API survey, crude and gasoline inventories dropped by 1.6 mb and 1.9 mb, in line with seasonal patterns.

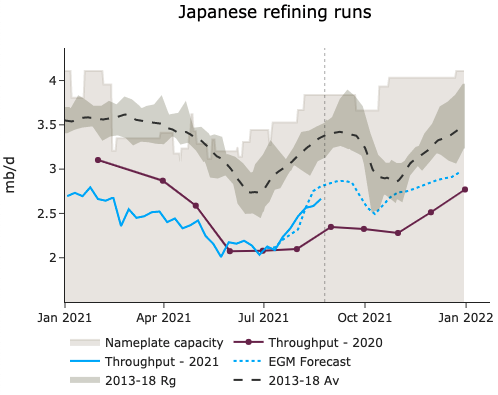

The impact of the pandemic in China likely peaked, as there is increasing evidence that demand is quickly recovering. Airlines are resuming flights in cancelled domestic routes, as COVID case counts plummeted over the last week. In August, State-owned refiners are ramping up their throughput to an 84% utilization rate August, as the Chinese government’s crackdown on private refiners leaves room for state-owned enterprises, especially in the refined product export market. In Japan, refining runs continue to climb up to 2.66 mb/d, as diesel prices in Asia strengthened.

Get more analysis and data with our Premium subscription

Ask for a free trial here