EUAs rebounded after the Polish auction presented a strong demand

Brent prompt futures continued to rally to 54.7 $/b on early Thursday as Saudi Arabia guaranteed that their voluntary supply cut would last two months…

Get more analysis and data with our Premium subscription

Ask for a free trial here

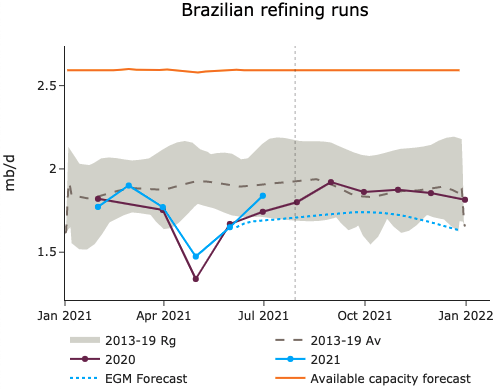

Crude prices continued to rise yesterday, to reach 75 $/b for the ICE Brent August contract on the backend of drawing US petroleum inventories and supportive macro environment for inflation. In their latest EIA data release, commercial crude stocks drew by 4.1 mb, in line with seasonal norms. Gasoline and distillate stocks both declined by respectively 2.3 mb and 3.1 mb, as demand remained elevated across the board. US production was revised down at 11.2 mb/d, more in line with our expectations, as the recent measurement of 11.4 mb/d seemed at odds with the frac spread count and the onshore rig count. The WTI-Brent narrowed shortly after, after reaching a weak 2.7 $/b, to 2.24 $/b. Brazilian runs increased more than expected in June, at 1.7 mb/d, when we expected low utilization rates throughout the year due to the pandemic.