Join EnergyScan

Get more analysis and data with our Premium subscription

Ask for a free trial here

The downward correction in Asian equity markets continues and the Nasdaq has had its worst day in more than two months. Bond yields are edging down (1.23% for the US 10y) and the USD seems regaining some ground after having weakened a bit yesterday (EUR/USD above 1.18).

The market is waiting for the end of the Fed meeting today (Statement at 8pm and press conference 1/2 h later CET). The key question is whether the Fed reveals details about its plan to taper bond purchases as soon as today. We think the resurgence of the pandemic in a context of sharp slowdown in the vaccination campaign should be invoked by the Fed to justify caution and we rather expect Jerome Powell to say more on this topic at the Jackson Hole symposium (August 26-28). There will be no update of the Fed’s macroeconomic and financial forecasts, so no new “Dots” today.

The IMF left its 6% global growth forecast unchanged for 2021 but revised its forecast for advanced countries upward, while downgrading its forecast for emerging countries: the main reason is the sharp difference in the pace of vaccine distribution that fuels a “two-speed recovery”. We will comeback on this topic in the last Weekly Economic Outlook before the summer break on Friday.

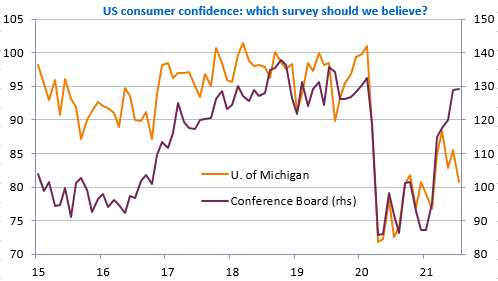

US economic reports released yesterday showed home prices accelerating to +17% yoy in June, durable goods orders increasing further and the Conference Board consumer confidence survey still pointing to strong optimism, at odds with the University of Michigan survey.

Get more analysis and data with our Premium subscription

Ask for a free trial here