Join EnergyScan

Get more analysis and data with our Premium subscription

Ask for a free trial here

ICE Brent prompt contracts declined to 74 $/b, from 76.5 $/b between Tuesday and today, as sources within OPEC+ mentioned that a deal was within reach between Saudi Arabia and the UAE. The UAE could potentially be allowed to pump 3.61 mb/d during the extension of the current deal, between April and December 2022. Following that, Iraq also mentioned that they would potentially re-negotiate their quotas, in light of the recent moves from the UAE. Details of the deal have yet to be confirmed, and we could potentially have to wait for a more formal OPEC+ meeting to have clear commitments from OPEC+ members (no meetings for August are scheduled yet). We believe the deal will likely affect production post-2021, and the UAE will return to the 2021 production plan suggested by Saudi Arabia and Russia, hereby ramping up production by 0.4 mb/d monthly increments.

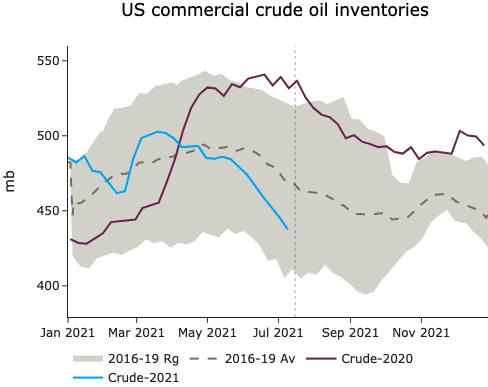

On the US side, a slightly bearish EIA weekly report showed continued draws in crude stocks (7.9 mb) while builds across gasoline, distillate and jet fuel stocks were respectively recorded at 1 mb, 3.7 mb, and -0.7 mb. Draws in the US crude inventories were helped by a decline in net crude imports of 1 mb/d w/w. Domestic crude production crept higher, at 11.4 mb/d. US WTI time spreads declined significantly, with a combination of rolling pressure from financial players and the prospects of higher net imports, boosted by a high WTI/Brent spread, which incentivized West African cargoes to flow West.

Get more analysis and data with our Premium subscription

Ask for a free trial here