Tropical storms may reduce US offshore production

ICE Brent prices reversed to 72.6 $/b, as the dollar surged against other currencies, due to the more hawkish US macro policy outlook. Interestingly, time…

Get more analysis and data with our Premium subscription

Ask for a free trial here

Prices dropped significantly yesterday in most European gas markets, pressured by higher supply and technical selling. Indeed, Russian supply rebounded to 310 mm cm/day on average yesterday, compared to 267 mm cm/day on Friday, as the Yamal pipeline has fully returned from maintenance. Norwegian flows increased to 342 mm cm/day on average, compared to 333 mm cm/day on Friday.

Note that the Managing Director of Nord Stream 2 AG said that the pipeline construction activities can be completed in August and the goal of the company is to launch the pipeline as early as in this year. This news also contributed to exert downward pressure.

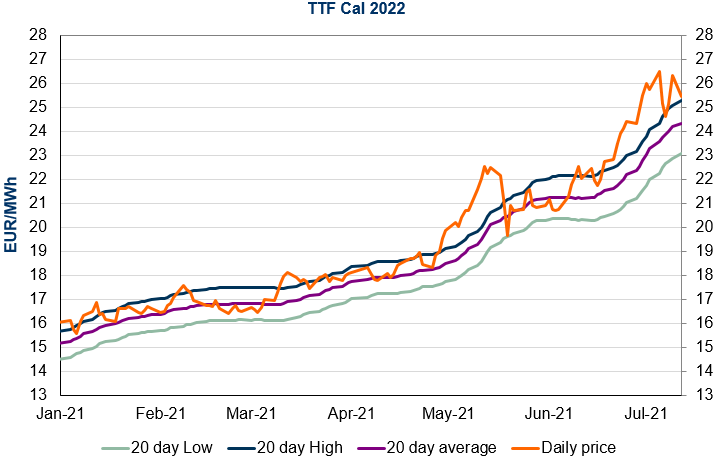

At the close, NBP ICE August 2021 prices dropped by 5.290 p/th day-on-day (-5.88%), to 84.730 p/th. TTF ICE August 2021 prices were down by 198 euro cents (-5.41%) at the close, to €34.649/MWh. On the far curve, TTF Cal 2022 prices were down by 87 euro cents (-3.29%), closing at €25.435/MWh.

The Nord Stream 1 gas pipeline is about to go for a 10-day planned maintenance on 13 July, which will significantly cut Russian flows. In addition to a likely technical rebound, this could lend support to European gas prices today.