Macro & Oil Report: Markets continue to adjust to the new interest rate scenario

Markets continue to adjust to the new interest rate scenario Macro & Oil #90 Rates continue to rise as we await January’s US inflation figures…

Get more analysis and data with our Premium subscription

Ask for a free trial here

Crude prices remained range-bound, at 74.5 $/b for the September ICE Brent contract, bond yields continued to slide lower, as the 10y Treasury bond touched 1.24% yesterday. However, this continued outflow from the commodity complex was balanced by strong fundamental data from the US. According to the EIA (detailed content here: Weekly EIA Report – Week to July 2nd), crude inventories dipped by 7 mb, while the US implied gasoline demand hit a historic high of 10 mb/d. US production surprised to the upside, with a 0.2 mb/d weekly increase, at 11.3 mb/d.

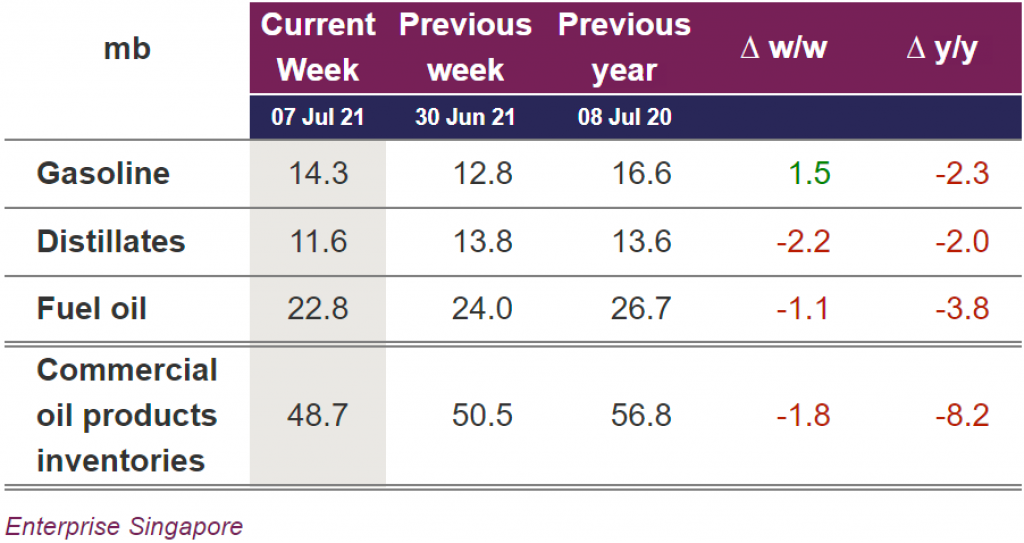

Looking at inventory data in Asia, total product stocks in Singapore declined by 1.8 mb, with gasoline stocks jumping by 1.5 mb, as mobility remained subdued in Asia. Distillates and fuel oil stocks declined respectively by 2.2 mb and 1.1 mb. Strong pulls on fuel oil stocks in Asia and the Middle East (via Fujairah) reflect a strong burning season.