Profit taking drove EUAs back down to 90€/t

Except in France where prices edged down on expectations of milder temperatures, the power spot prices posted slight gains in north western Europe yesterday, buoyed…

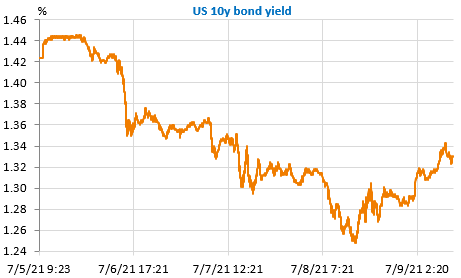

The exit from the “reflation trade” continued yesterday with a strong decline in equities and new lows for bond yields (1.25% for the US 10y). China fueled growth fears by signaling it could ease its policy very soon again. But the trend seems to be reversing (1.33% now): the sharp fall in bond yields has likely been amplified by technical factors and fears about the impact of the Delta variant on growth exaggerated.

Get more analysis and data with our Premium subscription

Ask for a free trial here

The ECB unveiled the outcome of its strategic review yesterday and conformed that the inflation target would now be 2% instead of “below but close to 2%”. Like the Fed, the ECB will also tolerate temporary overshooting and asset purchases will now include climate change criteria. The rebound in the EUR/USD that followed the announcement was likely a classic “buy the rumour, sell the fact” move. EUR/USD edged down again overnight to trade around 1.1830 now.

The economic agenda is light today. As explained above, the reflation trade could pick up some steam today.