Join EnergyScan

Get more analysis and data with our Premium subscription

Ask for a free trial here

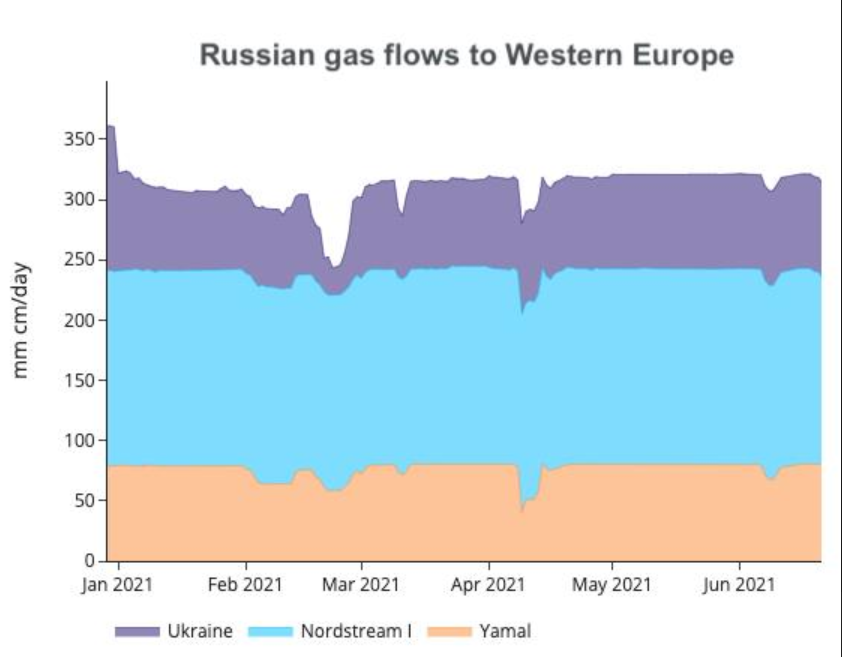

TTF ICE month-ahead prices traded as high as €30.24/MWh on Monday, breaching the €30/MWh mark for the first time since 2008. At the spot level, prices strengthened further as Norwegian gas imports were constrained by two unplanned outages and NW Europe LNG sendouts remained weak due to planned outages at Gate and Montoir import terminals. Firm entry capacity sales for the Russia-Ukraine Sudzha interconnection amounted to 15 mm cm/day for July delivery, the same volume than the two previous monthly firm capacity auctions. The last auction to purchase interruptible capacity for July delivery will take place on 29 June. With the annual shutdown of both Yamal and Nordstream pipelines planned in July (6-10 and 13-23 July respectively) and Gazprom holding an historically low volume into European gas storage sites (see graph in our Gas/Europe/Gas Stocks section here), some players may hope for additional interruptible capacity booking, which never happened since Ukrainian capacity was first auctioned in September 2020.

Get more analysis and data with our Premium subscription

Ask for a free trial here