Markets await the Fed with an eye on China

There was little significant movement in the financial markets, although equities continued to rise, with the CAC 40 breaking its record high from the internet…

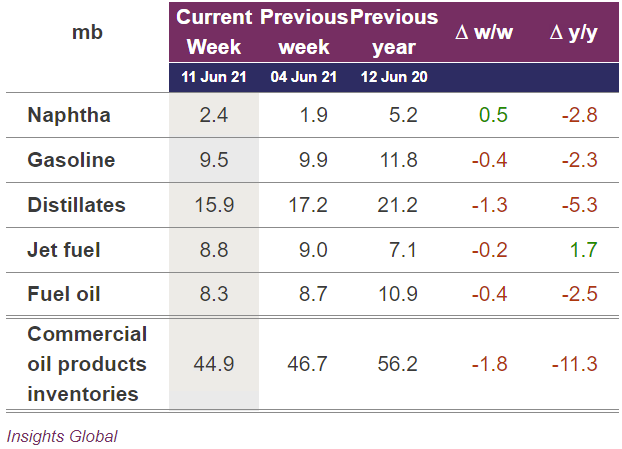

ICE Brent price climbed back to 72.5 $/b at the prompt, as US monthly inflation recorded at 5% for May, likely boosted demand for long-dated commodity futures contracts. Saudi Arabia announced that they rose production by close to 0.4 mb/d in May, but the market remained in an upward momentum phase, as all Middle Eastern OSPs priced a higher premium against benchmarks. Interestingly, despite large diesel imports from Asia, ARA inventories dipped last week by 1.3 mb, a 7% decline, potentially highlighting a return of gasoline demand in North-West Europe.

Get more analysis and data with our Premium subscription

Ask for a free trial here