Rangebound EUAs despite gains in the gas and power markets

The power spot prices were mixed in northwestern Europe yesterday, driven down in Germany and the Netherlands by forecasts of stronger wind output but slightly…

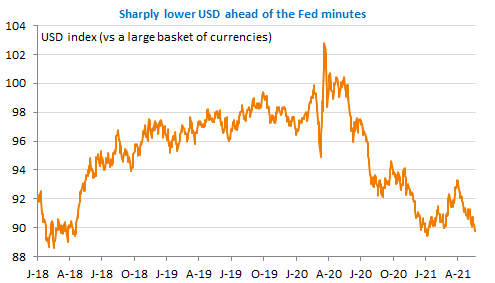

The USD is weakening quickly, as market participants expect the minutes of the last FOMC meeting to confirm the Fed’s willingness to tolerate a temporary surge in inflation. US equities posted losses for the second day in a row, but the bond market remained rather unchanged, with the US 10y around 1.64%. UK price data released this morning showed the inflation rate more than doubled in April, in line with expectations, but strong PPI figures point to further acceleration. Non-essential shops, cinemas, museums and café and restaurant terraces reopen today in France.

Get more analysis and data with our Premium subscription

Ask for a free trial here