Join EnergyScan

Get more analysis and data with our Premium subscription

Ask for a free trial here

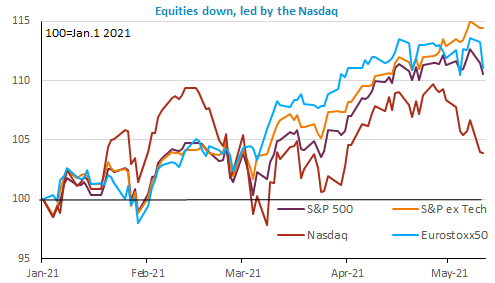

Significant market adjustments occurred on Wednesday and Thursday, as the US headline inflation was recorded at a 10-year high. The US consumer price index grew by 4.1% y/y in April and by 0.8% m/m, highlighting that the base effect from last year’s recession is not responsible for this acceleration in US inflation. Unsurprisingly, bond yields jumped, with the US 10 year benchmark touching 1.7% on Thursday and returning to 1.65% on early Friday. The Eurodollar remained volatile after its downward correction, which maintained nominal yields across Europe and the US to comparable levels. Finally, growth stocks, such as US tech, experienced a significant downward correction as future cashflows were increasingly discounted, due to a rise in inflation expectation, as the 5y spread between inflation-adjusted and nominal breached the 2.5% level.

Get more analysis and data with our Premium subscription

Ask for a free trial here