Join EnergyScan

Get more analysis and data with our Premium subscription

Ask for a free trial here

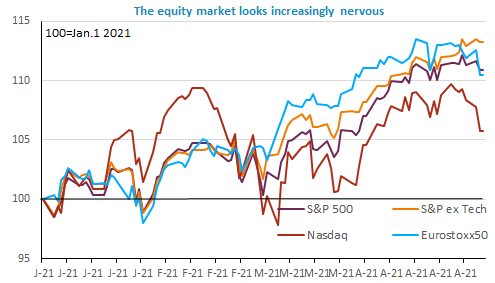

The equity market plunged yesterday, allegedly on comments from Janet Yellen that interest rates could rise as a result of massive stimulus packages in the US. The cause and effect link is far from being established and the market has been nervous for a while, especially in the tech sector. Besides, the bond and FX market barely reacted. The EUR/USD exchange rate is still trading slightly above 1.20. The large victory of the conservative People’s party in Madrid is a blow for the Socialist government but also a strong warning for governments in place in Germany and France: upcoming elections will be dominated by the management of the Covid crisis.

Get more analysis and data with our Premium subscription

Ask for a free trial here