Carbon prices edged up ahead of ENVI’s vote

The European power spot prices rose yesterday amid forecasts of higher demand induced by the current warm spell, and dropping wind output. The day-ahead prices…

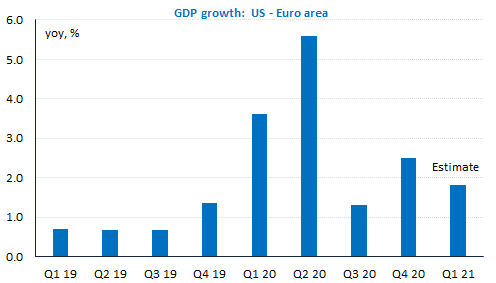

US GDP growth came out just below consensus expectations at +6.4% on a qoq annualized basis, which pushed bond yields a bit higher but also US equities to new record-high levels. The euro area figures will be released today and they should confirm the comeback in recession, despite the activity rebound in France. Chinese PMIs confirmed the activity slowdown, but remained solid. Available figures suggest inflation accelerated more than expected in the euro area in April. The EUR/USD exchange rate is stable above 1.21

Get more analysis and data with our Premium subscription

Ask for a free trial here