Join EnergyScan

Get more analysis and data with our Premium subscription

Ask for a free trial here

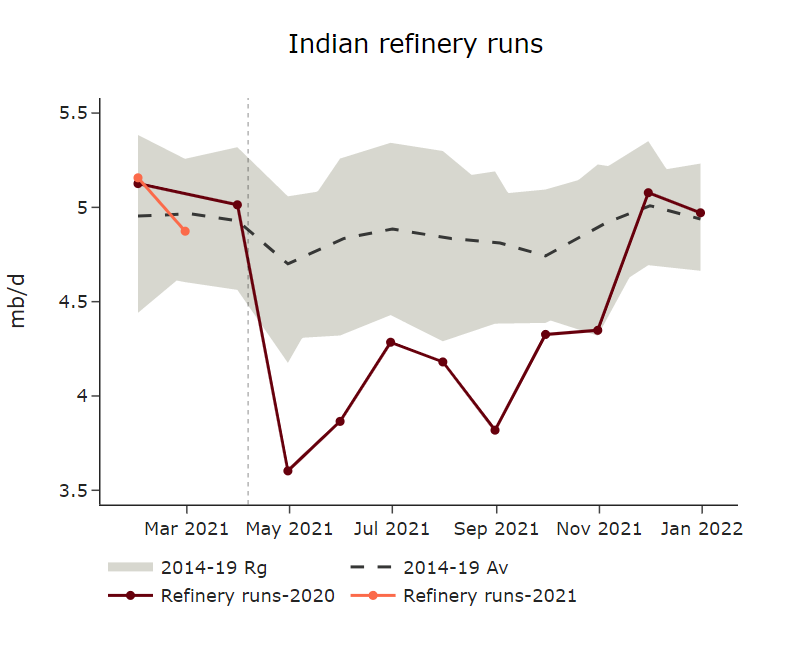

ICE Brent futures contracts recovered to 63 $/b on early Tuesday, after Monday’s price crash, with ICE Brent prompt future losing 4.2%. The loss was likely caused by increasing downside risk on demand, as France implemented a third nationwide lockdown and India reached record levels of cases reported within one day, pointing towards further lockdowns in targeted provinces. On the supply side, US-Iran talks about the nuclear deal are resuming, with firm decisions likely before Iranian elections on June the 18th and sanctions being lifted this summer/fall. Saudi OSPs over the weekend showed confident pricing to Asia and limited upside to Europe, as the Kingdom discounted its crude against Brent, as Saudis likely see short term weakness but should resume its constructive pricing for the next trading cycles.

Get more analysis and data with our Premium subscription

Ask for a free trial here