Join EnergyScan

Get more analysis and data with our Premium subscription

Ask for a free trial here

After having rallied on Friday, crude prices are retracing gains on early Monday, as ICE Brent prompt price hovers around 63.5 $/b. The Suez canal crisis continues to shape the short term dynamics of the crude oil and oil product markets as it remains still unresolved but seems to progress. The crude oil market is still expected to be mildly impacted by the shipping crisis as few crude oil tankers are in the canal’s backlog. On the product side, ample stocks for diesel, jet and gasoline limit the adverse effect on these markets. The Emirati crude oil marketing company ADNOC launched today their flagship crude oil future contract, hosted on the ICE Abu Dhabi exchange. The Murban crude oil future will progressively be the main pricing mechanism to price UAE’s crude exports. As such, cargo reselling is authorized, a stark contrast with its Middle-Eastern neighbours.

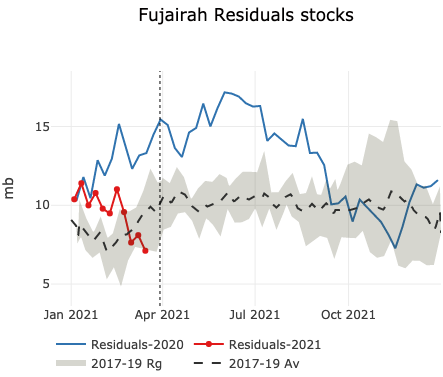

Fuel oil markets are expected to tighten significantly with Fujairah stocks at ultra-low levels ahead of the burning season, where middle eastern countries deplete stocks.

Get more analysis and data with our Premium subscription

Ask for a free trial here