Join EnergyScan

Get more analysis and data with our Premium subscription

Ask for a free trial here

Mixed sentiment on financial markets to start this week. US equities ended last week at record-high levels but volatility was high after a big family office was forced by its creditors to sell $20bn of shares. The situation remains uncertain in Europe, where a strong acceleration in vaccination campaigns is expected from April. Joe Biden is expected this week to unveil the main details of its long-term plan aimed at boosting the US growth potential by addressing key problems such as the poor state of public transportation infrastructure. The EUR/USD exchange rate is trading near 1.1780 and may fall further.

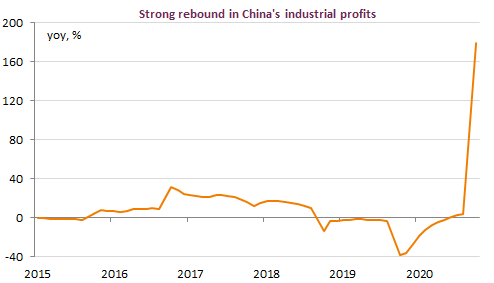

In China, industrial profits surged higher in January an February: +178.9% compared to the same period of last year. This is still due to a huge basis effect linked to the pandemic.

Get more analysis and data with our Premium subscription

Ask for a free trial here