French industry under pressure according to the latest Banque of France survey

A growing gas supply gap : a closer look at Europe and Asia gas balances over the 2000-2020 period The latest survey by the Banque…

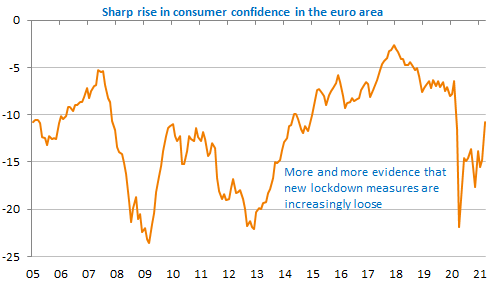

The sharp rise in the euro area PMIs as well as the consumer confidence indicators is at odds with the current narrative concerning the euro area. It may actually reflect the fact that lockdown measures are increasingly bypassed and, without any surprise, less and less efficient to stop the pandemic. Hopes are now fully placed in the strong rise in vaccine doses available from April. Financial markets are hesitant: bond yields have stabilized after a strong downward correction and the USD has followed the opposite path. The EUR/USD exchange rate is nearing 1.18.

Get more analysis and data with our Premium subscription

Ask for a free trial here