Sharp decline in China’s PMIs

A bad surprise in China, where the services purchasing managers’ index (PMI) fell well below the 50 level that separates contraction and expansion in activity…

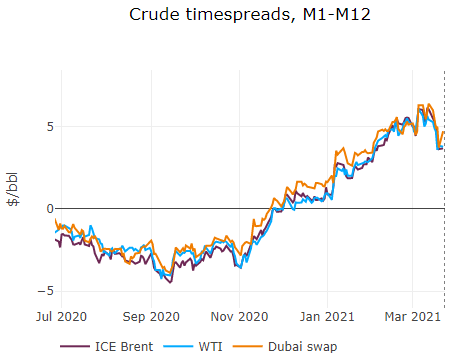

Brent and WTI 1st-nearby prices are trading below $64/b and $61/b respectively this morning. Time spreads are reducing quickly, pointing to strong concern about short-term demand prospects, as the delay in the vaccination campaign in Europe threatens the summer touristic season. The consensus is also pointing to the fifth weekly increase in a row in US crude inventories. OPEC output restrictions and worries about the recurrent attacks of the Houthis against Saudi Arabia oil infrastructure should nevertheless continue to support prices.

Get more analysis and data with our Premium subscription

Ask for a free trial here