Join EnergyScan

Get more analysis and data with our Premium subscription

Ask for a free trial here

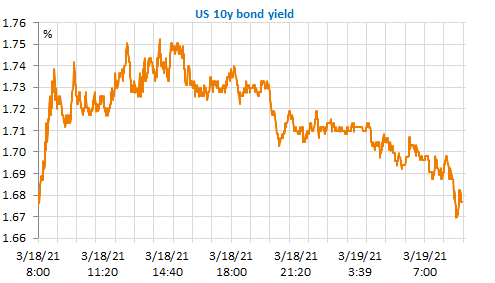

The initial markets’ reaction to the Fed’s optimistic and dovish message at the same time was positive on Thursday but it looks like they thought twice about it yesterday. Bond yields surged higher, the US 10y reaching 1.75%. Oil prices plunged and US equity markets did the same eventually, followed by most Asian indices overnight. Even if the bond market seems recovering a bit (prices up, yields down), European equities should register a marked downward correction. European countries will resume administrating AstraZeneca jabs after the green light of the EU medicine agency. Paris enters a 4-week lockdown, but the economic impact should be close to its efficiency, quite low. The EUR/USD erased its post Fed meeting gains yesterday, but seems resuming its ascent with lower US bond yields this morning.

Get more analysis and data with our Premium subscription

Ask for a free trial here