EUAs reversed from early sharp correction

The power spot prices surged for today in northwestern Europe, lifted by forecasts of below-average temperatures, low French nuclear availability and weak renewable generation. The…

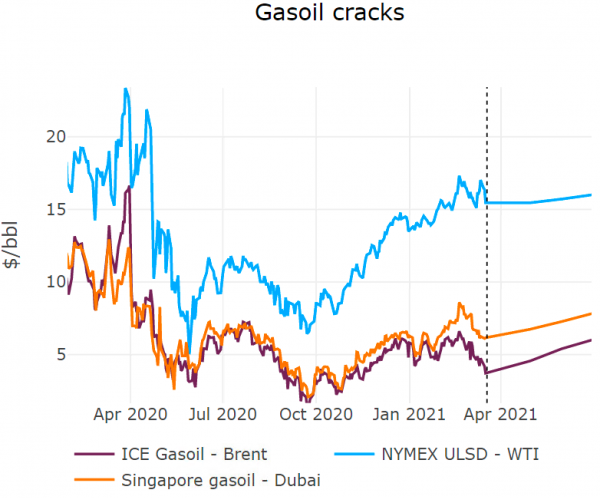

Crude prices continued to weaken on Wednesday despite the dollar edging lower, as the physical market’s weakness filtered through the futures’ market. Weak physical crude markets were combined with crashing diesel cracks, at the centre of refiners’ profitability. US petroleum stocks, reported by the EIA, showed a 3.6 mb build across crude and products. Sustained low refining runs continued to limit the demand side of the crude market. Gasoline shortages were resolved by a massive increase in imports, which will likely maintain cracks at elevated levels.

Get more analysis and data with our Premium subscription

Ask for a free trial here