Rallying by default

At 61 $/b, Brent prompt futures are now at their 7th consecutive positive session, boosted by a weakening dollar and Libyan output unable to ramp-up due…

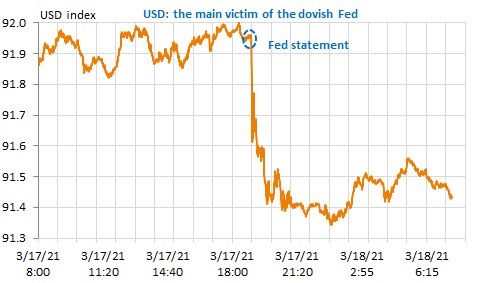

The Fed expressed more optimism about economic prospects, no worry about raising bond yields and saw no need to hike rates before 2024. The markets’ reaction was rather calm, but the USD plunged and the EUR/USD exchange rate rebounded unexpectedly from 1.19 to 1.1980.

Get more analysis and data with our Premium subscription

Ask for a free trial here