Join EnergyScan

Get more analysis and data with our Premium subscription

Ask for a free trial here

The power spot prices were mixed in North Western Europe yesterday, strongly rebounding in Belgium and the Netherlands but falling slightly further in Germany and France. Prices reached 22.29€/MWh in Germany, 37.36€/MWh and 37.15€/MWh in France and Belgium, and a much higher 48.75€/MWh in the Netherlands.

The milder temperatures continued to pressure the French power consumption on Thursday which fell by further 4.05GW to 59.86GW on average. The country’s nuclear generation faded as well by 0.66GW to 42.90GW. The German wind output surged by 28.20GW from Wednesday to 42.48GW on average and should remain near 41GW today.

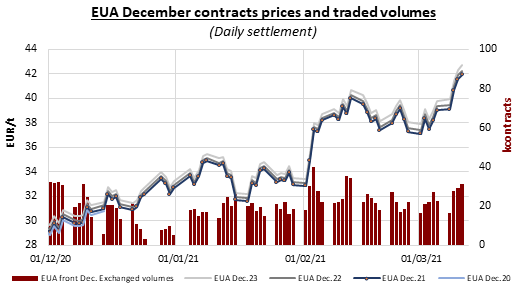

EUAs continued to climb on Thursday and extended their record to 42.67€/t most likely on further speculative buying amid buoyant financial markets and supportive energy complex. Emissions prices slightly corrected in the morning but rebounded after the morning’s auction despite the weak results of the sales with a 0.18€/t discount to the secondary market and below-average 1.67 cover ratio. The EUA Dec.21 contract eroded 0.64€/t over the last hour of trading after the European Commission launched a public consultation on the possible regulation of EUAs through a review of the “financial collateral arrangements” under the Financial Collateral Directive which, according to Carbon Pulse, could help banks or exchanges to use the carbon instruments as collateral for loans or to extend credit lines. The Dec.21 contract eventually settled at 41.93€/t, +0.39€/t day-on-day.

Lifted by the bullish gas and carbon markets, the power prices posted moderate gains along curve yesterday. The back end of the curve was rather stable in Germany, Belgium and the Netherlands, but the French calendar prices extended slight losses with the Cal23 fading by 0.28€/t from the day prior.

In other news, EDF permanently shut its 600MW Le Havre coal-fired plant three weeks before its planned closure, as higher output this winter has depleted coal stocks at the facility ahead of schedule.

Get more analysis and data with our Premium subscription

Ask for a free trial here