Bloody Friday

The crude futures market experienced a huge drawdown on Friday of close to 13% intraday, as the news that the omicron COVID variant was spreading…

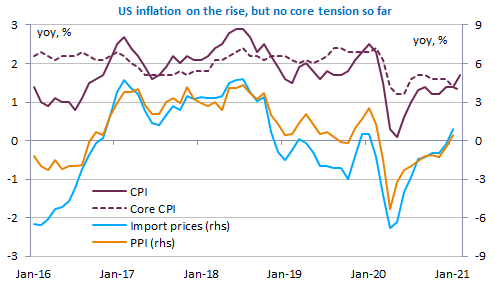

As expected, the House passed the stimulus bill yesterday. First checks will be sent as soon as this month the Treasury promised. In parallel, the bond market was reassured by lower-than-expected core inflation figures and a quiet 10-year Treasury bond auction. The US 10-y bond yield eased slightly further and the stock market posted some gains, except the Nasdaq that was marginally down. The USD lost some ground, the EUR/USD coming back above 1.19. The ECB meeting will be the main event today.

Get more analysis and data with our Premium subscription

Ask for a free trial here