Join EnergyScan

Get more analysis and data with our Premium subscription

Ask for a free trial here

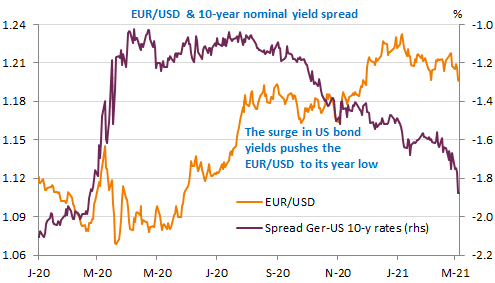

Jerome Powell, the Fed chairman, repeated more or less word for word what Lael Brainard said previously, but markets expected something more specific pointing to possible intervention to cap the rise in bond yields. So, the US 10y surged higher and remains above 1.56% this morning. The move triggered another sharp downward correction in US equities, the Nasdaq especially (-2.1%). The USD strengthened, the USD index (the trade-weighted index) even breaking its 100-day average for the 1st time since May last year. The EUR/USD exchange rate is back to its lowest level of the year, near 1.1950. The US job report will be released today and the big stimulus package should be voted by the Senate during the week-end.

Get more analysis and data with our Premium subscription

Ask for a free trial here